Buy Bitcoin with Credit Card: The Ultimate Guide for 2024

Introduction

Bitcoin, the digital currency that has revolutionized financial transactions, can be purchased effortlessly using a credit card. This method, characterized by speed and convenience, allows for fast purchases of Bitcoin. Despite its advantages, it's crucial to understand the complexities and potential pitfalls associated with this transaction mode.

This article aims to demystify the process of buying Bitcoin with a credit card. It will dissect the benefits and risks tied to this approach. As an essential highlight, ChangeNow, Changelly, and Switchere three leading instant swap exchanges ideal for credit card purchases of Bitcoin, will be thoroughly examined.

Here's what you'll find in this article:

- Benefits: A deep dive into the primary advantages of using a credit card for Bitcoin purchases.

- Risks: An exploration of potential hazards and how they can impact your transactions.

- Top Instant Swap Exchanges: An in-depth look at ChangeNow, Changelly, and Switchere, their features, pros, cons, and step-by-step guides on using them.

Armed with this knowledge, you will have the power to make informed decisions about purchasing Bitcoin with a credit card while navigating the exciting world of cryptocurrency. This article is your go-to guide for understanding and utilizing these processes effectively.

The Advantages and Risks of Buying Bitcoin with a Credit Card

When it comes to purchasing Bitcoin, using a credit card offers several benefits.

Advantages of Buying Bitcoin with a Credit Card

- Convenience: Using a credit card to purchase Bitcoin epitomizes ease. With just a few clicks, anyone can convert fiat currency into Bitcoin from almost any location around the globe.

- Speed: Credit card transactions are processed rapidly, which means Bitcoin can often be acquired within minutes. This is particularly valuable in the volatile crypto market where prices can change quickly.

Risks of Buying Bitcoin with a Credit Card

- Higher fees: Credit card purchases typically incur higher transaction fees compared to other methods like bank transfers. These fees can significantly reduce the overall investment returns on Bitcoin.

- Interest charges: If not paid off immediately, credit card balances accrue interest, adding an additional cost to the purchase of Bitcoin.

- Potential for debt: The ease of using credit cards can sometimes lead to impulsive buying decisions, which, combined with crypto market volatility, may increase the risk of accruing unmanageable debt.

Buying Bitcoin with a credit card presents a mix of Pros and Cons that should be carefully evaluated. While the speed and convenience offered are undeniable, it is crucial to consider the financial impacts of higher costs and the possibility of debt. Armed with this knowledge, individuals can make more strategic decisions in their journey to acquire Bitcoin through credit cards.

Top Instant Swap Exchanges for Buying Bitcoin with a Credit Card

Instant swap exchanges have changed the game for buying Bitcoin with a credit card. These platforms let you convert cryptocurrencies instantly, without dealing with complicated order books. It's fast, convenient, and perfect for anyone who wants to get their hands on Bitcoin quickly.

Why Choose an Instant Swap Exchange?

When it comes to buying Bitcoin with a credit card, instant swap exchanges offer some key advantages:

- Convenience: No need to wait for your order to be matched with a buyer or seller.

- Speed: Transactions are processed instantly, so you get your Bitcoin right away.

- Versatility: These exchanges support a wide range of cryptocurrencies, giving you more options for trading.

What to Look for in an Instant Swap Exchange

When choosing the best exchange for buying Bitcoin with a credit card, here are a few important factors to consider:

- Security: Make sure the exchange has strong security measures in place to protect your funds and personal information.

- Reputation: Look for exchanges that have been around for a while and have a good reputation among users.

- Exchange Rates: Check if the exchange offers competitive rates that reflect the current market conditions.

Now that we know what to look for, let's dive into three of the top instant swap exchanges for buying Bitcoin with a credit card:

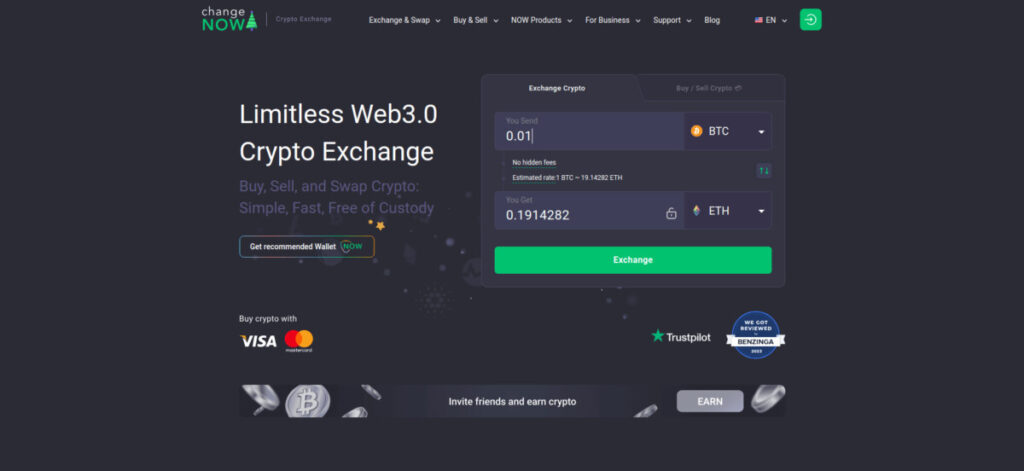

ChangeNow: A Detailed Review

ChangeNow is an instant cryptocurrency exchange that has been serving the crypto community since 2017. It's known for its user-friendly interface and wide range of supported cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and over 200 others.

The platform doesn't require account registration, which not only makes it easy to start trading but also ensures a high level of privacy for its users. ChangeNow accomplishes this by implementing a non-custodial policy, meaning they don't hold your funds; instead, transactions happen directly between users' wallets.

In addition to its simplicity and privacy features, ChangeNow also prides itself on offering competitive exchange rates. The exchange uses an algorithm that finds the best rates across several trading platforms and provides them to its users. This means you're always getting a fair deal when you trade on ChangeNow.

Furthermore, ChangeNow has a robust security system in place to protect user transactions. It employs industry-leading encryption technology and maintains a strict AML/KYC policy which further upholds its commitment to security.

Overall, ChangeNow offers a quick and convenient way to buy and trade cryptocurrencies with a credit card or other payment methods. Whether you're a beginner or an experienced trader looking for versatility and convenience, ChangeNow can be an excellent choice.

Pros of Using ChangeNow

Here are some reasons why people love using ChangeNow:

- No account registration necessary, ensuring privacy.

- A vast array of supported cryptocurrencies for versatile trading.

- High limits for credit card transactions, fostering substantial purchases.

Cons of Using ChangeNow

Of course, no exchange is perfect. Here are a few downsides to consider:

- Exchange rates may fluctuate during the transaction process.

- Some users may prefer an exchange that supports fiat withdrawals.

A Step-By-Step Guide: How to Buy Bitcoin on ChangeNow with a Credit Card

In the dynamic world of cryptocurrency, convenience is key. ChangeNow, with its user-friendly interface and robust security features, offers a seamless experience for buying Bitcoin using a credit card. If you're ready to dive in, here's a detailed step-by-step guide that will navigate you through the process.

Step 1: Initiate Your Transaction on ChangeNow

Start by visiting the ChangeNow website. The platform's simple layout makes it easy for both beginners and experienced traders. The homepage will present you with a ‘Quick Exchange' section where you'll initiate your transaction.

Step 2: Select Your Currencies

In the ‘You Pay' field, select your credit card's currency. In the ‘You Get' field, choose ‘Bitcoin' as your desired cryptocurrency. As you enter your credit card currency equivalent, ChangeNow automatically calculates the approximate amount of Bitcoin you'll receive based on real-time exchange rates.

Step 3: Input Your Bitcoin Wallet Address

Next, input your Bitcoin wallet address in the designated field. This is where ChangeNow will send your purchased BTC. Please double-check this address to avoid any transaction errors. If you don't have a Bitcoin wallet yet, you can click on ‘Don't have a crypto wallet yet?' to get suggestions from ChangeNow.

Step 4: Confirm Your Transaction

Before proceeding further, verify all the details of your transaction – from the currencies selected to the wallet address inputted. Once everything is in order, confirm your transaction by clicking on ‘Confirm'.

Step 5: Process Your Payment

Finally, enter your credit card details in the provided fields. You may need to complete additional verification steps required by your bank or card issuer for security purposes.

Note: The time it takes for the BTC to reflect in your wallet may vary depending on network congestion. But rest assured, ChangeNow strives to process transactions as swiftly as possible.

By following these steps, you'll be able to buy Bitcoin on ChangeNow with a credit card effortlessly. As you navigate the exciting world of cryptocurrency, remember that ChangeNow is here to make your journey secure and convenient.

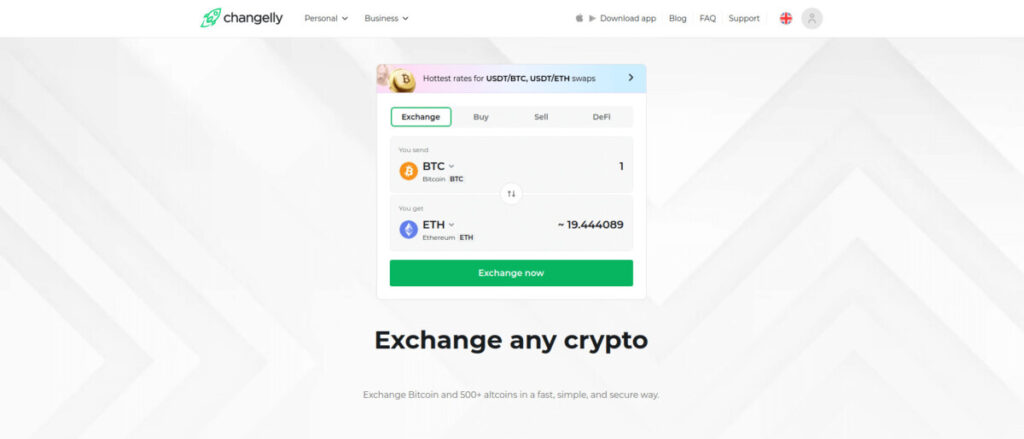

Changelly: An In-depth Analysis

Changelly is an instant cryptocurrency exchange that was established in 2015. It's headquartered in Prague, Czech Republic, but offers its services worldwide. The platform is known for its intuitive and user-friendly interface, which is ideal for both new and experienced traders.

Changelly offers access to over 150 cryptocurrencies and prides itself on transparent fees, fast transactions, and 24/7 live support. It also provides a unique feature of exploring the best trading pairs among different platforms to give its users the most profitable deal.

Despite its strengths, it's important for users to understand the potential drawbacks before using Changelly. These include higher fees compared to some other exchanges and limited payment methods beyond credit cards.

Overall, Changelly is a versatile option for those looking to buy Bitcoin with a credit card, as long as they are aware of the potential costs and limitations.

Pros of Using Changelly

Here are some advantages of using Changelly for buying Bitcoin:

- User-friendly design suitable for beginners and experienced traders alike.

- No registration needed for fast transactions.

- Support for multiple fiat currencies adds convenience.

Cons of Using Changelly

However, there are a couple of drawbacks to be aware of:

- Higher fees compared to some other exchanges may apply.

- Limited payment methods beyond credit cards could be restrictive for some users.

How to Purchase Bitcoin on Changelly with a Credit Card

Ready to give Changelly a try? Follow these steps to buy Bitcoin with your credit card:

- Access Changelly: Start at the Changelly website or mobile app.

- Choose Cryptocurrency: Select ‘Bitcoin' as your target cryptocurrency and specify the amount in your local currency.

- Verify Wallet Address: Clearly input your Bitcoin wallet address where you want BTC delivered.

- Confirm & Pay: Double-check all details for accuracy then proceed with payment using your credit card details.

- Receive Bitcoin: After successful payment verification, Changelly will process the exchange, and you will receive Bitcoin directly into your wallet.

Changelly's strength lies in its user-friendly interface that guides even novice users through buying Bitcoin effortlessly and securely.

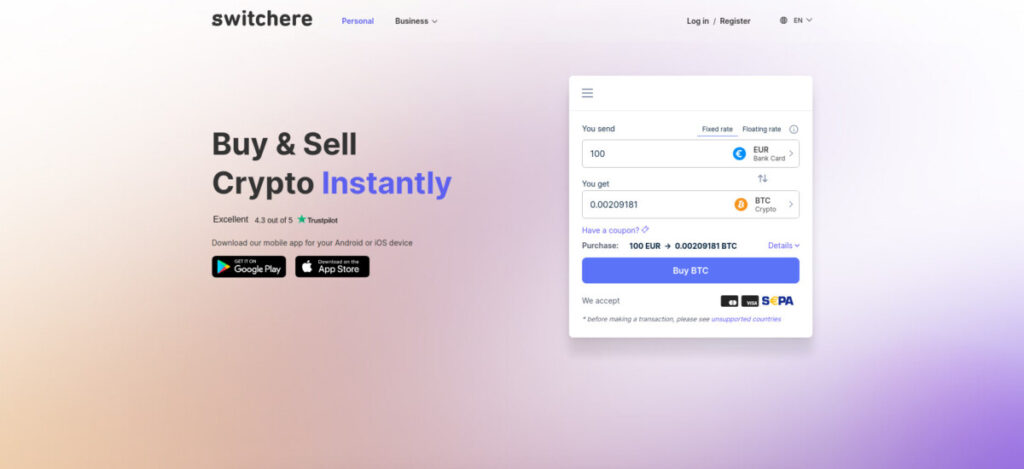

Switchere: A Comprehensive Overview

Another alternative to consider is Switchere, an instant swap exchange that offers a seamless experience for buying Bitcoin with a credit card. With its intuitive interface and quick transactions, it's suitable for users of all levels. Switchere is known for its competitive fees, wide range of payment options including credit cards, bank transfers and e-wallets, as well as transparent pricing. Users are always aware of what they'll be paying upfront – no hidden charges or surprises.

Pros of Using Switchere

Here are some advantages of using Switchere:

Competitive fees: Switchere offers competitive fees, which can result in cost savings for frequent traders.

Wide range of payment options: In addition to credit cards, Switchere supports various payment methods such as bank transfers and e-wallets, giving users more flexibility.

Transparent pricing: Switchere provides transparent and upfront pricing, ensuring that users know exactly what they'll be paying.

Cons of Using Switchere

However, there are a few downsides to consider:

Limited cryptocurrency options: While Switchere supports popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, the range of available coins is somewhat limited compared to other exchanges.

KYC requirements: Like many regulated platforms, Switchere requires users to complete a Know Your Customer (KYC) process, which involves providing identification documents. This could be seen as a drawback for those seeking anonymity.

Despite these limitations, Switchere remains a reliable option for purchasing Bitcoin.

How to buy Bitcoin on Switchere with a Credit Card

Here's a step-by-step guide on buying Bitcoin on Switchere using a credit card:

- Sign up: Create an account on the Switchere website and complete the registration process.

- KYC verification: Provide the necessary identification documents to complete the KYC process.

- Select cryptocurrency and amount: Choose Bitcoin as the cryptocurrency you want to buy and enter the desired amount in either Bitcoin or your local currency.

- Choose payment method: Select “Credit Card” as your preferred payment method.

- Enter card details: Input your credit card information, including the card number, expiration date, and CVV code.

- Review transaction details: Take a moment to review the transaction details, including fees and exchange rate.

- Confirm purchase: Once you're satisfied with the details, click “Confirm” to initiate the purchase.

- Receive Bitcoin: After your payment is processed successfully, the purchased Bitcoin will be deposited into your designated wallet address.

Remember to exercise caution when storing and handling your cryptocurrency investments.

In conclusion, while Switchere has its pros and cons, its user-friendly interface, competitive fees, and wide payment options make it a viable choice for individuals looking to buy Bitcoin with ease and transparency.

Alternative Exchanges with Credit Card Payment Options

Exploring the landscape of cryptocurrency purchasing options, there are Other Exchanges that allow you to buy Bitcoin using your credit card. These platforms offer a more traditional trading experience compared to instant swap exchanges, with features like price charting and market orders.

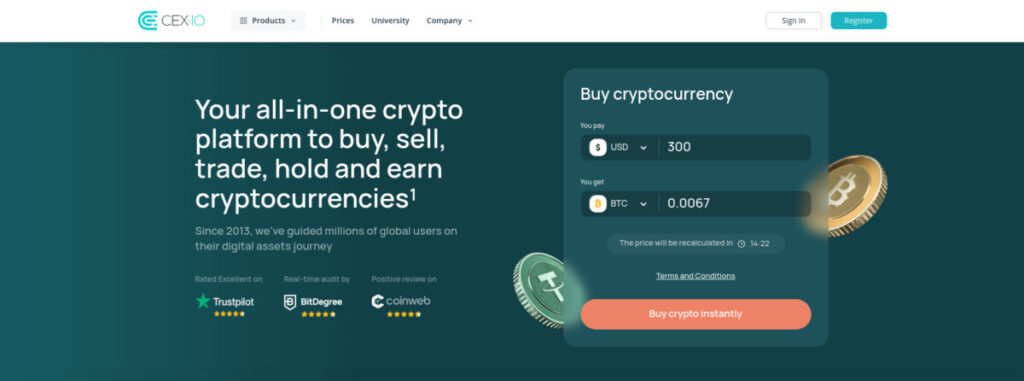

Cex.io: A Versatile Exchange

Cex.io is a popular cryptocurrency exchange that offers a wide range of services including buying, selling, and trading different digital currencies. Established in 2013, the platform has built a solid reputation for its comprehensive security measures and user-friendly interface suitable for both beginners and advanced traders.

The platform supports several payment methods including credit card transactions which allows users to buy Bitcoin directly. Cex.io is also known for providing reliable customer support and offering competitive rates for trading. One of the unique features of Cex.io is its margin trading option, which offers users the potential for greater profits.

Before you can start buying Bitcoin on Cex.io with your credit card, there are a few steps to follow.

How to Buy Bitcoin with Credit Card using Cex.io

Buying Bitcoin with a credit card on Cex.io involves the following steps:

- Account Creation: Visit the Cex.io website and click on the ‘Sign Up' button. Enter your email address and create a strong password. You will receive a confirmation email; click on the link provided to verify your account.

- Identity Verification: After successfully creating your account, you need to go through the Know Your Customer (KYC) process. Click on ‘Profile' from the dashboard menu and select ‘Verification'. You'll be required to provide personal information such as full name, address, and date of birth. Additionally, you will need to upload a clear photo of a government-issued ID and a selfie.

- Adding Payment Method: Once your identity is verified, you can add your credit card as a payment method. Go to ‘Finance' in the dashboard menu and select ‘Add new card'. Fill in your card details accordingly.

- Buying Bitcoin: Next, go back to the dashboard and select ‘Buy/Sell'. Choose ‘Bitcoin' from the list of cryptocurrencies available. Enter the amount you wish to purchase or the amount you want to spend in USD (or your local currency). Double-check all details, then click ‘Buy'.

- Confirm Purchase: A window will pop up showing all transaction details (including fees). If everything is correct, confirm by clicking ‘Proceed'. You'll be redirected to your credit card provider's page for final authorization.

- Check Your Wallet: Once the transaction is successful, check your wallet on Cex.io; your newly purchased Bitcoin should reflect in your balance.

Coinbase: A User-Friendly Option

Another popular platform in this category is Coinbase, known for its beginner-friendly interface, making it easy for beginners to navigate the platform. The platform provides a wide range of cryptocurrencies for trading, including Bitcoin, Ethereum, Litecoin, and more.

Coinbase has a strong reputation for security and has implemented various measures to protect user funds. Users can also earn rewards through Coinbase's educational program.

While Coinbase does have its advantages, it's worth noting that the platform charges relatively high fees compared to other exchanges. Additionally, some users have reported issues with customer support and occasional delays in transactions.

Here's what makes Coinbase stand out:

- Ease of Use: Coinbase is designed to be simple and straightforward, making it easy for first-time buyers to get started with Bitcoin.

- Educational Resources: The exchange provides a wide range of educational content to help users learn about cryptocurrencies.

- Security Measures: Coinbase has strong security measures in place to protect users' funds and personal information.

To use these exchanges, you'll typically need to go through a registration process:

- Account Creation: Sign up and provide your personal details to create an account.

- Identity Verification: Complete the necessary verification steps (KYC) to comply with regulations.

- Wallet Setup: Create or link a digital wallet where your purchased Bitcoin will be stored.

By using platforms like Coinbase, you can purchase Bitcoin with a credit card while also getting access to helpful resources for navigating the crypto world effectively.

Key Considerations for Buying Bitcoin with Credit Card

When diving into the world of cryptocurrency, buying Bitcoin with a credit card stands out for its speed and simplicity. However, it demands a careful analysis of one's personal financial landscape and an understanding of the inherent risks. Ensuring a secure transaction is paramount to protect both your financial and digital assets.

Assess Your Financial Standing

- Budget Wisely – Ascertain your financial capabilities before embarking on purchases. Bitcoin's price volatility can result in significant gains but also substantial losses.

- Understand Fees and Interest – Credit card companies often classify Bitcoin purchases as cash advances, leading to higher fees and interest rates that can quickly accumulate.

- Manage Debt Risk – With the convenience of credit comes the temptation to overspend. Keep debt levels manageable to avoid financial strain.

Tips for Secure Transactions

- Enable Two-Factor Authentication (2FA) – This adds an extra layer of security to your exchange account, significantly reducing the risk of unauthorized access.

- Whitelist Withdrawal Addresses – By setting up withdrawal address whitelisting, you ensure that even if your account is compromised, funds can only be withdrawn to your pre-approved addresses.

By adhering to these guidelines, you position yourself to navigate the crypto ecosystem with greater assurance and control. As you prepare for your first purchase or seek to expand your portfolio, these considerations serve as cornerstones for a responsible and strategic approach to buying Bitcoin with a credit card.

Conclusion

Aspiring Bitcoin investors are encouraged to explore the recommended instant swap exchanges, ChangeNow, Changelly and Switchere. These platforms offer a seamless experience for those looking to buy Bitcoin with a credit card.

The convenience of buying Bitcoin with a credit card is undeniable. It allows for:

- Swift transactions

- Easy access even for beginners

- Immediate ownership of the purchased Bitcoins.

However, it's worth noting that this convenience comes with certain caveats. These include higher fees and potential interest charges, both of which could offset the benefits if not properly managed.

Keeping in mind these potential risks, it is crucial to approach this method with a clear understanding of personal financial situation and the associated risks. This involves taking necessary security measures such as enabling Two-Factor Authentication (2FA) and whitelisting withdrawal addresses.

The world of cryptocurrency awaits you. Embark on this journey equipped with the necessary tools and understanding, ready to harness the transformative potential of Bitcoin.

FAQs(Frequently Asked Questions)

What are the advantages of buying Bitcoin with a credit card?

The advantages of buying Bitcoin with a credit card include convenience, swift transactions, easy access even for beginners, and immediate ownership.

What are the risks of buying Bitcoin with a credit card?

The risks of buying Bitcoin with a credit card include higher fees, potential classification as cash advances by credit card companies, and the temptation to overspend and accrue debt.

Why choose an instant swap exchange for buying Bitcoin with a credit card?

Instant swap exchanges offer quick and seamless transactions, making it easier to buy Bitcoin with a credit card. They also provide competitive fees and a user-friendly experience.

What are the pros of using ChangeNow for purchasing Bitcoin with a credit card?

Some reasons why people love using ChangeNow include no account registration requirement, fast transactions, and support for a wide range of cryptocurrencies.

How can I buy Bitcoin on ChangeNow with a credit card?

To buy Bitcoin on ChangeNow with a credit card, follow the step-by-step guide provided in the detailed review section or on the ChangeNow platform.

What are the key considerations for buying Bitcoin with a credit card?

Key considerations include assessing your financial standing and budgeting wisely, understanding fees and interest associated with credit card purchases, and managing debt risk to avoid overspending.