The Ultimate Guide to Non KYC Crypto Exchanges (2025): Trade Privately Without ID

In an era where privacy is becoming a rare commodity, many cryptocurrency users are actively seeking ways to trade without handing over personal documents. This guide explores the world of non KYC crypto exchanges — what they are, why they matter, and how you can use them safely in 2025. Whether you're new to crypto or simply tired of invasive verification, you're in the right place.

🧩Introduction

🔹What Are Non KYC Crypto Exchanges?

Non KYC crypto exchanges are trading platforms that allow users to buy, sell, or swap cryptocurrencies without submitting identity verification documents like passports or driver's licenses. These exchanges skip the traditional “Know Your Customer” (KYC) process — a regulatory standard in most financial systems — and instead offer users immediate access to crypto trading with minimal sign-up friction.

🔎 Looking for a full list of 50+ platforms?

Check out our updated, categorized database here:

➡️ See All No KYC Crypto Exchanges

🔹A Brief History of KYC in Crypto

The concept of KYC was introduced into the cryptocurrency space around 2013–2014, as regulators worldwide began tightening rules on digital asset platforms. Initially, many exchanges operated anonymously, aligned with Bitcoin’s original ethos of decentralized, permissionless money.

However, as the crypto market matured and institutional money flowed in, regulatory bodies like the SEC, FATF, and FinCEN started enforcing KYC/AML (Anti-Money Laundering) compliance. Today, most major exchanges require full ID verification for trading or even account creation.

🔹Why the Demand for Non KYC Crypto Exchanges Is Rising

Despite regulatory pressure, the demand for non KYC crypto exchanges continues to grow in 2025 due to:

- Rising concerns over privacy and data security

- Ongoing surveillance and overreach by governments and corporations

- Increased restrictions in certain countries or on specific assets

- The crypto-native belief in sovereignty, anonymity, and decentralization

More users now seek platforms that allow fast, anonymous access to global crypto markets — especially for small trades, DeFi usage, or cross-border transactions.

🔹Why This Guide Matters in 2025

In a time of growing regulatory complexity, this guide serves as a comprehensive roadmap for privacy-conscious crypto users. Whether you're a newcomer or a seasoned trader looking to avoid KYC hurdles, this resource will help you:

- Understand how non KYC exchanges work

- Assess their legal and technical risks

- Choose platforms aligned with your values and risk tolerance

- Stay safe while trading outside traditional verification systems

From DEXs and P2P platforms to instant swaps and privacy coins — this is your complete reference for navigating the world of non KYC crypto exchanges in 2025.

🧠Understanding KYC in Cryptocurrency

🔍 What Is KYC/AML and Why Does It Exist?

Know Your Customer (KYC) is a regulatory framework that requires financial institutions — including cryptocurrency exchanges — to verify the identity of their users. This is typically done to comply with Anti-Money Laundering (AML) laws and to prevent illicit activities such as terrorism financing, tax evasion, and fraud.

For crypto platforms, KYC procedures often involve collecting personal information like:

- Full legal name

- Government-issued ID (passport, driver’s license)

- Proof of address (utility bills or bank statements)

- Selfie or video verification for facial matching

While these rules were originally designed to enhance financial security, many critics argue that they also introduce serious privacy risks and surveillance concerns — especially in the permissionless world of crypto.

🧾 Standard KYC Requirements on Exchanges

Most centralized exchanges today require users to complete KYC before allowing:

- Fiat deposits or withdrawals

- High-volume crypto trades

- Margin or futures trading

- Access to advanced trading tools

Even decentralized apps (dApps) are facing pressure to integrate KYC layers, particularly those involving fiat gateways or operating under U.S. or EU jurisdiction.

🌍 The Regulatory Landscape in 2025

In 2025, crypto regulation continues to evolve rapidly:

- The U.S. has introduced Form 1099-DA, requiring platforms to report user trades to the IRS.

- The EU’s MiCA framework pushes exchanges toward full KYC/AML compliance.

- Travel Rule enforcement is expanding globally, requiring exchanges to share user information on cross-border transactions.

- Several Asian markets have introduced stricter KYC onboarding, with biometric ID checks now becoming common.

As a result, fewer platforms remain fully KYC-free — making access to non KYC crypto exchanges increasingly valuable for users who prioritize privacy and decentralization.

🧭 The Ideological Divide: Crypto’s Privacy Ethos vs Regulation

The original promise of cryptocurrency, as envisioned by Satoshi Nakamoto, was peer-to-peer, borderless, and censorship-resistant finance. KYC stands in stark contrast to that vision — introducing centralized control, identity exposure, and gatekeeping into an ecosystem designed to bypass such systems.

This ongoing tension has created two paths in the industry:

- Regulated platforms offering compliance and institutional trust

- Non KYC platforms focusing on anonymity, sovereignty, and user freedom

This guide is here to help you understand — and safely navigate — the latter.

📈 Recent Developments Impacting KYC in Crypto

Some key recent changes shaping the KYC environment:

- Crackdowns on non-compliant exchanges (e.g., Binance and Bitzlato enforcement actions)

- Increased geoblocking of users from sanctioned regions

- More on-chain surveillance tools adopted by governments and analytics firms

- Emerging discussions around decentralized identity (DID) as a compromise between privacy and regulation

As the rules tighten, the existence and use of non KYC crypto exchanges becomes not only a practical option — but also a philosophical choice for many in the crypto community.

🚀 Why Traders Seek Non-KYC Exchanges

As regulatory pressure on the crypto industry intensifies, more users are turning to non KYC crypto exchanges to regain control over their financial privacy, access global markets more freely, and preserve the original values that cryptocurrencies were built on. Here’s why these platforms are attracting traders in growing numbers:

🛡️ Privacy and Data Protection Concerns

With data breaches and surveillance becoming commonplace, many users are unwilling to share sensitive personal documents — such as ID scans, selfies, and utility bills — with centralized exchanges. Non KYC crypto exchanges reduce exposure to these risks by allowing users to trade without ever submitting personal information.

This protects individuals from:

- Identity theft

- Government surveillance

- Misuse or sale of personal data

- Arbitrary freezing of accounts

🏴 Philosophy of Financial Sovereignty and Decentralization

For many in the crypto space, avoiding KYC isn't just about convenience — it’s about freedom. KYC introduces centralized control into a system meant to be borderless, open, and user-controlled. Non-KYC platforms align more closely with the principles of:

- Self-custody

- Permissionless access

- Trustless financial systems

Choosing a non KYC exchange is often an expression of alignment with Bitcoin’s original ethos.

⚡ Faster Onboarding and Trading

Non KYC platforms eliminate the delays associated with identity verification — some of which can take days or even weeks. Traders can often:

- Start trading immediately

- Withdraw small amounts without verification

- Use temporary or no accounts at all

This is especially important during volatile market conditions when timing is everything.

🔐 Protection From Data Breaches and Identity Theft

Centralized platforms with KYC data are prime targets for hackers. There have been numerous breaches where users' passport photos, addresses, and financial information were leaked or sold.

By using non KYC crypto exchanges, users greatly minimize the attack surface and avoid the risk of their private information falling into the wrong hands.

🌍 Accessibility for Underbanked Populations

In many regions — especially in parts of Africa, Latin America, and Southeast Asia — people lack access to reliable ID documentation or banking infrastructure. For these users, KYC requirements are an outright barrier to entry.

Non KYC platforms provide a gateway to global finance for millions of unbanked or underbanked individuals.

🌀 Avoiding Exposure to Regulatory Volatility

Crypto regulations change frequently, and platforms that once didn’t require KYC can quickly reverse course under pressure. Traders using those services can find themselves:

- Suddenly locked out of accounts

- Unable to withdraw funds

- Forced to submit documents retroactively

By sticking to non KYC exchanges, users reduce their exposure to abrupt policy shifts or legal crackdowns.

🧠 Ideological Alignment With the Crypto Ethos

At its core, the crypto movement was built to disrupt centralized finance, not replicate it. For many early adopters and cypherpunk-inspired users, using a KYC-based platform feels like compromising the movement.

Non KYC exchanges enable those who care deeply about financial autonomy, privacy rights, and resistance to censorship to act in line with their values.

🧩 Types of Non-KYC Cryptocurrency Exchanges

Not all non KYC crypto exchanges operate the same way. They differ in how they handle custody, anonymity, user experience, and trading functionality. Here are the key categories you’ll encounter in 2025:

🔒 1. Fully Anonymous Exchanges (No KYC At All)

These are the rarest — and most privacy-focused — platforms that do not ask for any identity verification under any conditions, regardless of trade size or volume.

- No account creation required

- No email, phone number, or documentation

- Often used for fast, low-friction trades or swaps

- Examples: WizardSwap, XChange (for small trades)

💡 Best for: Privacy maximalists, small trades, quick swaps without tracking

🧮 2. Tiered KYC Exchanges (KYC Only Above a Threshold)

These platforms offer limited access without KYC, but require identity verification for higher limits or advanced features.

- Withdrawal limits (e.g., $2,000/day) without KYC

- KYC unlocks fiat deposits, margin trading, or large transfers

- Examples: MEXC, Phemex, PrimeXBT

💡 Best for: Traders who want flexibility — start without KYC and upgrade if needed

🤝 3. Peer-to-Peer (P2P) Trading Platforms

P2P exchanges connect buyers and sellers directly. Most use escrow smart contracts or multi-sig wallets to facilitate secure trades without identity checks.

- No centralized custody

- No KYC by default — identity sharing is optional between users

- Dispute systems and moderator support are common

- Examples: Bisq, Hodl Hodl, LocalCoinSwap

💡 Best for: Private fiat-to-crypto or crypto-to-crypto trades, especially in restricted regions

🔁 4. Decentralized Exchanges (DEXs)

DEXs allow users to trade directly from their wallets using smart contracts, typically on Ethereum or other EVM-compatible chains.

- No signup or KYC

- User maintains custody at all times

- Requires use of Web3 wallet (e.g., MetaMask, Rabby Wallet)

- Examples: Uniswap, Curve, ThorSwap, Jupiter

💡 Best for: Swapping tokens directly without third-party custody or data collection

₿ 5. Bitcoin-Only Non-KYC Solutions

Some platforms and tools focus exclusively on non-KYC Bitcoin trading or storage, catering to BTC maximalists.

💡 Best for: Bitcoiners who want to avoid altcoin ecosystems and stay fully sovereign

🔄 6. Non-Custodial Swap Services

These platforms allow instant token swaps without custody or user accounts. They aggregate prices across multiple DEXs or CEXs and execute the trade on-chain.

- No registration or KYC required

- Limited interface, but fast execution

- Examples: ChangeNOW, SideShift, LetsExchange, StealthEx

💡 Best for: Quick cross-chain swaps without revealing identity or email

🕶️ 7. Privacy Coin-Focused Exchanges

Some exchanges specialize in privacy-preserving assets like Monero (XMR), Pirate Chain (ARRR), or Zcash (ZEC), and intentionally avoid KYC as part of their mission.

- Often outside of U.S./EU regulatory reach

- Support for privacy tools and shielded transactions

- Examples: TradeOgre, NonKyc

💡 Best for: Trading in privacy-focused ecosystems with aligned philosophical goals

By understanding the different types of non KYC crypto exchanges, you can select platforms that align best with your privacy preferences, technical comfort level, and trading needs.

🏆 Top Non-KYC Centralized Exchanges in 2025

In 2025, several centralized exchanges continue to offer non-KYC trading options despite increasing regulatory pressure. These platforms vary widely in their features, security measures, and limitations. Here's a detailed breakdown of the leading options:

1. MEXC

MEXC has established itself as one of the leading non-KYC exchanges in 2025, offering an impressive range of assets and trading features while maintaining reasonable privacy options for users who prefer not to verify their identity.

Key Features:

- Trading Volume & Liquidity: $1.5+ billion daily volume with deep liquidity across major pairs

- Supported Cryptocurrencies: 1,600+ cryptocurrencies including new listings and micro-cap gems

- Fee Structure: Competitive 0.2% spot trading fee (taker/maker), with 30% discount for MEXC token holders

- Withdrawal Limits: Up to 10 BTC daily without KYC (approximately $900,000 at current rates)

- Security Features: Cold wallet storage for 95% of assets, insurance fund, and risk management system

- Geographical Restrictions: Not available to US residents or sanctioned countries

- User Experience: Modern, intuitive interface with advanced features for experienced traders

- Mobile App: High-rated apps for iOS and Android with full trading functionality

- Customer Support: 24/7 live chat and email support in multiple languages

- Trading Tools: Spot, futures (up to 200x leverage), copy trading, grid bots, and earning products

Our Take: MEXC stands out for its extensive altcoin selection and generous non-KYC withdrawal limits, making it ideal for privacy-focused traders who still want access to a full-featured exchange. Just be aware that the platform has been gradually tightening KYC requirements, and users report receiving notifications to complete verification.

2. Phemex

Phemex has maintained its position as a trader-friendly platform with optional KYC, particularly appealing to those interested in derivatives trading.

Key Features:

- Trading Volume & Liquidity: $800+ million daily volume, primarily in derivatives

- Supported Cryptocurrencies: 250+ spot trading pairs and 100+ contract markets

- Fee Structure: 0.1% maker/0.1% taker for spot; 0.01% maker/0.06% taker for contracts

- Withdrawal Limits: Up to $50,000 USD daily without KYC

- Security Features: Multi-signature cold wallet system, regular security audits, zero security breaches since launch

- Geographical Restrictions: No service to US, UK, Singapore, Quebec, and sanctioned regions

- User Experience: Clean, professional interface designed for serious traders

- Mobile App: Feature-complete mobile trading with advanced charting capabilities

- Customer Support: 24/7 support with average response time under 1 hour

- Trading Tools: Advanced order types, cross-margin, isolated margin, and up to 100x leverage

Our Take: Phemex offers one of the best derivatives trading experiences without mandatory KYC. Their platform stability during high volatility and responsive interface make it a favorite among active traders. However, their spot market offerings are more limited compared to competitors.

3. BTSE

BTSE maintains a tiered verification approach that allows for basic trading without full KYC, catering to both casual and professional traders seeking privacy.

Key Features:

- Trading Volume & Liquidity: $400+ million daily volume with focus on major cryptocurrencies

- Supported Cryptocurrencies: 100+ cryptocurrencies and 250+ trading pairs

- Fee Structure: 0.15% maker/0.15% taker, with volume-based discounts

- Withdrawal Limits: Up to $100,000 USD daily with email verification only

- Security Features: Multi-signature technology, 100% cold storage for funds, regular Merkle Tree proof-of-reserves

- Geographical Restrictions: Not available in US, Japan, and sanctioned countries

- User Experience: Professional trading interface with customizable widgets

- Mobile App: Full-featured mobile trading platform for iOS and Android

- Customer Support: 24/7 support via chat and email, typically responding within 2 hours

- Trading Tools: Spot, futures, options, OTC desk, and lending services

Our Take: BTSE offers institutional-grade security while still providing non-KYC options for smaller traders. Their multi-currency wallet system is particularly useful for internationally-minded users. The platform is highly reliable but offers fewer exotic altcoins compared to MEXC.

4. SimpleFX

SimpleFX has positioned itself as a user-friendly trading platform that maintains non-KYC access while offering both crypto and traditional market trading.

Key Features:

- Trading Volume & Liquidity: Moderate volume ($50-100 million daily)

- Supported Assets: 60+ cryptocurrencies plus forex, indices, stocks, and commodities

- Fee Structure: 0% commission on crypto (spread-based model), $0.01 per share for stocks

- Withdrawal Limits: No specified limit for crypto withdrawals without KYC

- Security Features: Cold storage for majority of funds, segregated client accounts

- Geographical Restrictions: Available globally with some feature limitations

- User Experience: Simple, beginner-friendly interface with MetaTrader 4/5 integration

- Mobile App: Highly-rated mobile apps with full trading functionality

- Customer Support: 24/5 support via chat and email

- Trading Tools: Up to 500x leverage, one-click trading, and technical analysis tools

Our Take: SimpleFX stands out for allowing complete account creation with just an email address. The platform bridges the gap between crypto and traditional markets, making it excellent for diversified traders seeking privacy. However, their crypto-specific features aren't as robust as pure crypto exchanges.

5. Pionex

Pionex has carved out a niche as the leading automated trading platform that still offers non-KYC options for users under certain thresholds.

Key Features:

- Trading Volume & Liquidity: $300+ million daily volume

- Supported Cryptocurrencies: 330+ cryptocurrencies and trading pairs

- Fee Structure: Flat 0.05% fee for all trades (both maker and taker)

- Withdrawal Limits: Up to $50,000 USD daily with email verification only

- Security Features: Partnership with Fireblocks for institutional-grade security

- Geographical Restrictions: Not available to US residents (separate Pionex.US platform requires KYC)

- User Experience: Clean, user-friendly interface designed for automated trading

- Mobile App: Robust mobile app with full bot management capabilities

- Customer Support: 24/7 support via chat and email

- Trading Tools: 16+ built-in trading bots, including Grid Trading, DCA, and Arbitrage bots

Our Take: Pionex offers the most comprehensive suite of trading bots available without mandatory KYC. The platform is ideal for passive investors who want to automate their strategy while maintaining privacy. Their low, flat fee structure is particularly appealing for high-frequency strategies.

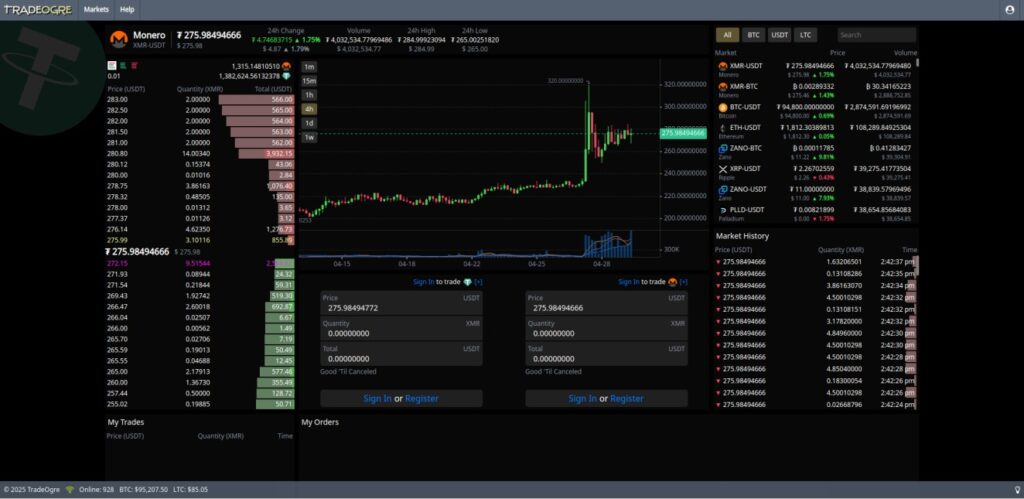

6. TradeOgre

TradeOgre remains one of the few truly no-KYC exchanges in 2025, maintaining complete anonymity for users despite the regulatory environment.

Key Features:

- Trading Volume & Liquidity: Lower volume ($5-15 million daily) with adequate liquidity for supported pairs

- Supported Cryptocurrencies: 120+ cryptocurrencies with focus on privacy coins and mining-related assets

- Fee Structure: Flat 0.2% fee on all trades

- Withdrawal Limits: No limits on withdrawals, no KYC required

- Security Features: Basic but effective security with no major breaches reported

- Geographical Restrictions: No official restrictions (use at your own risk)

- User Experience: Minimalist, retro interface with essential trading features

- Mobile App: No official mobile app

- Customer Support: Email-only support with variable response times

- Trading Tools: Basic order types only (limit, market)

Our Take: TradeOgre is the closest thing to the original crypto exchange experience — completely anonymous with no frills. The platform is best suited for privacy maximalists and those trading privacy-focused coins. The downside is the basic interface and lower liquidity compared to larger exchanges.

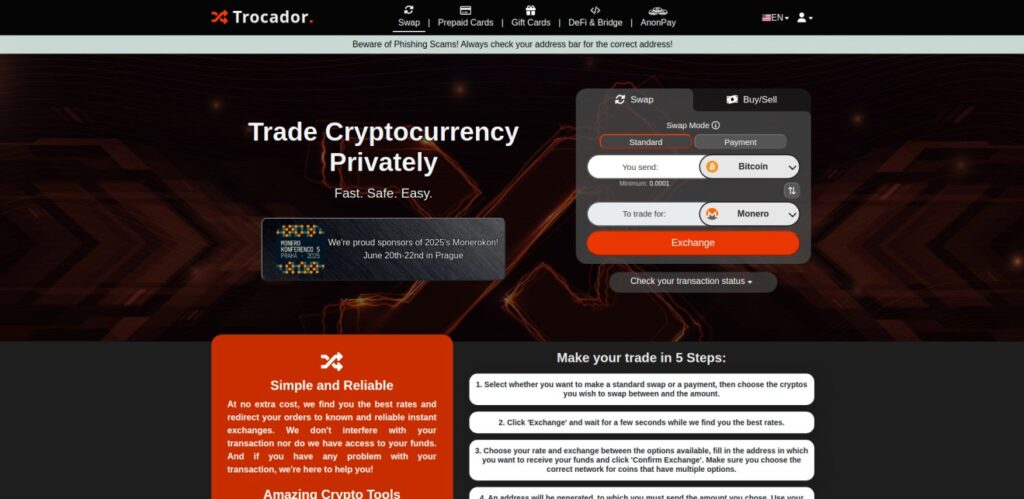

7. Trocador

Trocador has emerged as a popular non-KYC instant exchange service that prioritizes privacy and speed.

Key Features:

- Trading Volume & Liquidity: Aggregates liquidity from multiple sources

- Supported Cryptocurrencies: 300+ cryptocurrencies with strong privacy coin support

- Fee Structure: Variable 0.5-1% fee depending on the pair (included in exchange rate)

- Withdrawal Limits: No limits, no KYC required

- Security Features: Non-custodial model (minimal security risk)

- Geographical Restrictions: No official restrictions

- User Experience: Simple, streamlined interface focused on quick swaps

- Mobile App: Mobile-optimized website but no dedicated app

- Customer Support: Email support with 24-48 hour response time

- Trading Tools: Basic swap functionality only

Our Take: Trocador excels at quick, private exchanges between cryptocurrencies without requiring any personal information. The service is particularly valuable for privacy coin users, though the fees are higher than traditional exchanges.

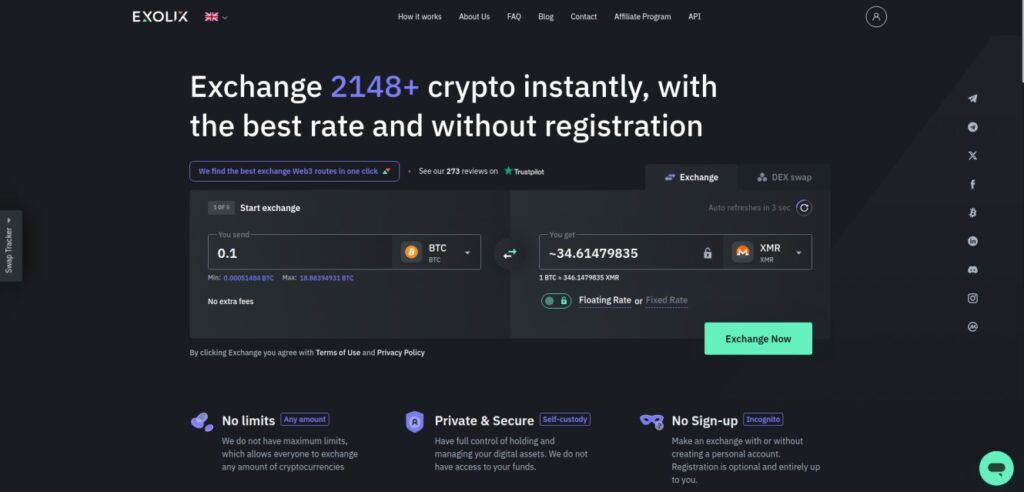

8. Exolix

Exolix provides non-KYC crypto-to-crypto exchanges with a focus on simplicity and accessibility.

Key Features:

- Trading Volume & Liquidity: Moderate volume through aggregated liquidity

- Supported Cryptocurrencies: 400+ cryptocurrencies and tokens

- Fee Structure: No explicit fees (built into exchange rate, approximately 0.5-2%)

- Withdrawal Limits: No limits for crypto-to-crypto exchanges

- Security Features: Non-custodial service with minimal data collection

- Geographical Restrictions: Available globally with some limitations

- User Experience: Clean, minimalist interface designed for one-time exchanges

- Mobile App: Well-designed mobile app for iOS and Android

- Customer Support: 24/7 support via chat and email

- Trading Tools: Fixed and floating rate exchanges, affiliate program

Our Take: Exolix is ideal for users who want to quickly exchange cryptocurrencies without registration or KYC. The service is reliable and straightforward, though the built-in fees are higher than what you'd find on traditional exchanges.

9. LocalCoinSwap

LocalCoinSwap continues to be a leading P2P exchange that enables fiat-to-crypto trading without mandatory KYC.

Key Features:

- Trading Volume & Liquidity: Varies by region and payment method

- Supported Cryptocurrencies: 25+ cryptocurrencies with BTC, ETH, and stablecoins dominating

- Fee Structure: 1% fee for makers, free for takers (plus spread determined by individual traders)

- Withdrawal Limits: No platform-imposed limits

- Security Features: Escrow protection, reputation system, dispute resolution

- Geographical Restrictions: Available globally with varying payment methods

- User Experience: Functional marketplace design with clear listings

- Mobile App: Progressive web app but no native mobile application

- Customer Support: Human support with 24-hour response time, community moderators

- Trading Tools: Escrow system, encrypted messaging, reputation metrics

Our Take: LocalCoinSwap provides one of the few remaining ways to convert fiat to crypto without KYC. The P2P nature means higher fees and more friction than centralized exchanges, but it remains invaluable for privacy-focused users who need fiat onramps.

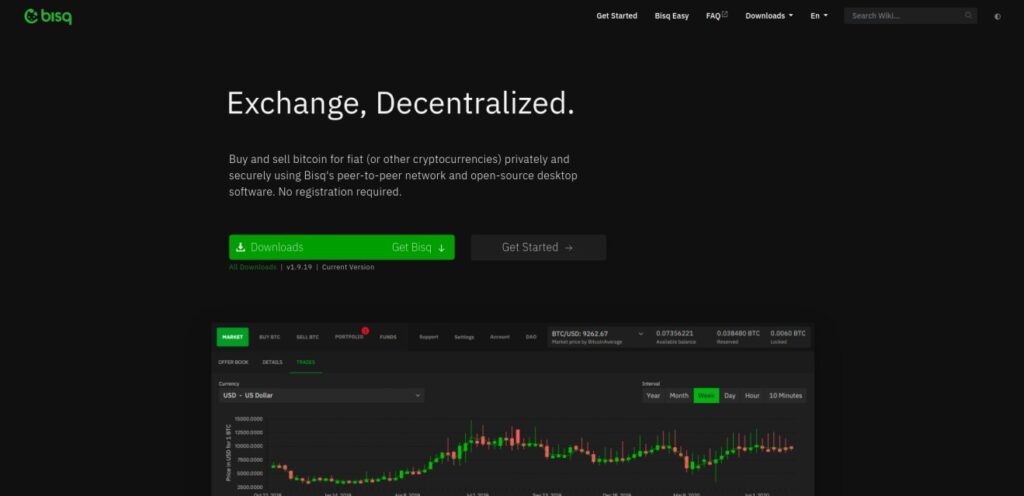

10. Bisq

Bisq remains the gold standard for decentralized, non-KYC Bitcoin trading in 2025.

Key Features:

- Trading Volume & Liquidity: $5-10 million daily volume, primarily in BTC pairs

- Supported Cryptocurrencies: BTC and 20+ altcoins

- Fee Structure: 0.1% trading fee + mining fee for transactions

- Withdrawal Limits: No limits (P2P network)

- Security Features: Fully decentralized, multi-signature escrows, security deposits

- Geographical Restrictions: None (runs on local machine)

- User Experience: Desktop application with moderate learning curve

- Mobile App: No mobile app (desktop only)

- Customer Support: Community support via forums and chat

- Trading Tools: Secure messaging, arbitration system, reputation metrics

Our Take: Bisq offers the highest level of privacy and censorship resistance for Bitcoin trading. The desktop-only software and learning curve make it less convenient than web-based alternatives, but it remains the most secure option for non-KYC Bitcoin trading.

📊 Comparative Table: Non-KYC Centralized Exchanges (2025)

| Exchange | Daily Volume | Cryptocurrencies | Trading Fee | Non-KYC Withdrawal Limit | Geographic Restrictions |

| MEXC | $1.5B+ | 1,600+ | 0.2% | 10 BTC/day | No US |

| Phemex | $800M+ | 250+ | 0.1% | $50,000 USD/day | No US, UK |

| BTSE | $400M+ | 100+ | 0.15% | $100,000 USD/day | No US |

| SimpleFX | $50-100M | 60+ | Spread-based | Unlimited | Limited |

| Pionex | $300M+ | 330+ | 0.05% | $50,000 USD/day | No US |

| TradeOgre | $5-15M | 120+ | 0.2% | Unlimited | None official |

| Trocador | Variable | 300+ | 0.5-1% | Unlimited | None official |

| Exolix | Variable | 400+ | 0.5-2% | Unlimited | Limited |

| LocalCoinSwap | Variable | 25+ | 1% (maker) | Unlimited | None |

| Bisq | $5-10M | 20+ | 0.1%+ | Unlimited | None |

🔍 What To Look For When Choosing a Non-KYC Exchange

When selecting from these platforms, consider these critical factors:

- Balance between privacy and functionality – More features often mean more data collection

- Actual withdrawal limits – These can change without notice and may be lower in practice

- Security history – Research past breaches or issues before depositing funds

- Liquidity depth – High volume doesn't always mean good liquidity for specific pairs

- Jurisdiction risk – Where an exchange is based affects its regulatory exposure

Most importantly, remember that even non-KYC exchanges may be forced to implement verification requirements as regulations evolve. Always keep funds you're not actively trading in self-custody wallets, and consider using multiple exchanges to minimize counterparty risk.

In the 2025 landscape, the exchanges offering the best balance of privacy, security, and functionality are MEXC, Phemex, and Pionex for centralized options, with Bisq remaining the gold standard for truly private Bitcoin trading.

Want to explore even more platforms?

We’ve reviewed over 50+ non KYC crypto exchanges, including smaller and specialized options.

🔗 Exploring DEXs: Non-KYC Trading Without Centralized Platforms

While this guide focuses on centralized platforms offering non-KYC access, decentralized exchanges (DEXs) play a major role in the anonymous crypto ecosystem. DEXs let you trade directly from your wallet without ever creating an account or submitting identification.

No signups. No KYC. Just wallet-to-wallet swaps — fully on-chain.

Platforms like Uniswap, PancakeSwap, Jupiter, and aggregators like 1inch or CoW Swap allow you to trade thousands of tokens without any intermediary. They're especially valuable for:

- Trading long-tail or privacy tokens

- Staying fully sovereign and censorship-resistant

- Avoiding centralized custody altogether

However, DEXs also come with their own risks — smart contract vulnerabilities, fake tokens, and front-running attacks are real concerns for users.

👉 Want to dive deeper into decentralized trading?

We’ve built a full guide on DEXs, aggregators, privacy tools, and cross-chain swaps at our sister site:

➡️ Explore Decentralized Exchanges on DeFiShills.com »

There, you'll find:

- DEX comparisons by chain and use case

- Gas fee optimization strategies

- Security tips and wallet setups

- The best tools for anonymous DeFi trading in 2025

❓FAQ and Troubleshooting

🧠 What are non KYC crypto exchanges?

Non KYC crypto exchanges are platforms that allow users to trade cryptocurrencies without completing traditional identity verification processes (e.g., submitting an ID or proof of address). Some platforms require no signup at all, while others offer limited services before asking for KYC at higher thresholds.

🌍 Are non-KYC exchanges legal?

It depends on your jurisdiction. Some countries tolerate or ignore KYC-free trading at small volumes; others, like the U.S. and EU, enforce stricter compliance. Even if you’re using a non KYC platform, you are still responsible for reporting income and capital gains in most countries.

🛑 Why can't I access certain non-KYC exchanges?

Many platforms geo-block users based on local regulations (e.g., U.S. IP addresses). Solutions include:

- Using a VPN (check legality in your region)

- Trying decentralized platforms with no frontend restrictions

- Switching to mobile/web3 wallets with DEX integration

Reminder: Circumventing geo-blocks may violate local laws — always research your risks.

⚙️ What if a non-KYC exchange suddenly adds KYC?

This happens more often than people expect — especially under regulatory pressure. If this occurs:

- Withdraw your funds as soon as possible

- Switch to alternative platforms or DEXs

- Maintain multiple accounts or wallets to avoid reliance on a single exchange

🔐 How can I stay safe while trading without KYC?

- Only use small amounts you can afford to risk

- Favor platforms with proof-of-reserves, security audits, or open-source code

- Self-custody your funds in secure wallets (hardware or multi-sig if possible)

- Use privacy techniques: CoinJoin, VPNs, Tor, and privacy wallets

- Keep your browser and wallet software updated

📚 Where can I learn more?

To go deeper into safe, private crypto usage, check out these guides and resources from BitShills:

Bitcoin Mixing and Onchain Tracking: What You Need to Know

Understand how mixing services and blockchain analytics affect your privacy and what techniques help you stay anonymous.

The Ultimate Guide to the Best VPN Services for Crypto Users

Protect your location and identity while trading or accessing exchanges with top-rated VPN tools.

Best Crypto Tax Software – The Ultimate Guide

⚠️ Reminder: Trading on non-KYC exchanges doesn’t exempt you from tax obligations in most countries. Use reliable crypto tax tools to track your trades and remain compliant.

🧭 Conclusion

Non KYC crypto exchanges represent a crucial corner of the crypto ecosystem — offering users a pathway to financial privacy, sovereignty, and faster onboarding. But they’re not without trade-offs.

In 2025, the lines between privacy and compliance are more blurred than ever. Choosing to trade without KYC means:

- Accepting greater personal responsibility for security and tax reporting

- Staying updated on regulatory shifts

- Balancing privacy tools with the convenience of centralized services

- Understanding your local laws and risks

💡 Final Recommendations:

- Use non KYC exchanges for small or privacy-sensitive transactions, not as a permanent custodian

- Always verify a platform’s current KYC policy — they can change overnight

- Diversify your trading strategy across CEXs, DEXs, and P2P

- Take control of your funds with self-custody wallets and backup procedures

- Stay informed — the regulatory landscape is evolving fast, and today’s loophole could be tomorrow’s compliance trap

In a world pushing for more surveillance, the right to transact freely and privately is worth protecting. Non-KYC crypto exchanges give you that option — when used wisely.