Buy Bitcoin with Cash: The Ultimate Guide for 2024

Introduction

Welcome to the Ultimate Guide to Buy Bitcoin with Cash in 2024. In the evolving landscape of cryptocurrency, cash purchases remain a crucial entry point for many individuals.

Why Choose Cash Transactions?

Cash transactions offer an array of advantages:

- Anonymity: Cash transactions protect your identity as they do not require personal banking information.

- Accessibility: By using cash, even unbanked or underbanked individuals can participate in the Bitcoin market.

- Immediate settlement: Unlike wire transfers or other digital payment methods, cash transactions are immediate and irrevocable.

This guide will navigate you through diverse avenues for buying Bitcoin with cash. We scrutinize various platforms, including Bitcoin ATMs, AgoraDesk, LocalCoinSwap, Hodl Hodl, and Bisq. Each section provides an in-depth examination of the platform and a step-by-step guide to executing a transaction.

We also highlight the potential risks and rewards of cash transactions. With foresight, we explore future trends in the Bitcoin market that could impact these transactions.

Embrace this journey into purchasing Bitcoin with cash. Gain the knowledge you need to confidently engage in this transformative financial world.

Buying Bitcoin with Cash

1. Bitcoin ATMs

As cryptocurrency continues to gain acceptance and popularity, Bitcoin ATMs are emerging as an accessible option for buying Bitcoin with cash. Akin to regular ATMs but with a crypto twist, these machines allow anyone to purchase Bitcoin using fiat currency.

To utilize a Bitcoin ATM, no bank account is necessary. A user can simply walk up to the machine, feed in cash and receive Bitcoin directly into their digital wallet. Some machines even offer two-way operations, allowing users to sell their Bitcoin for cash.

How do Bitcoin ATMs work?

Using a Bitcoin ATM involves a few simple steps:

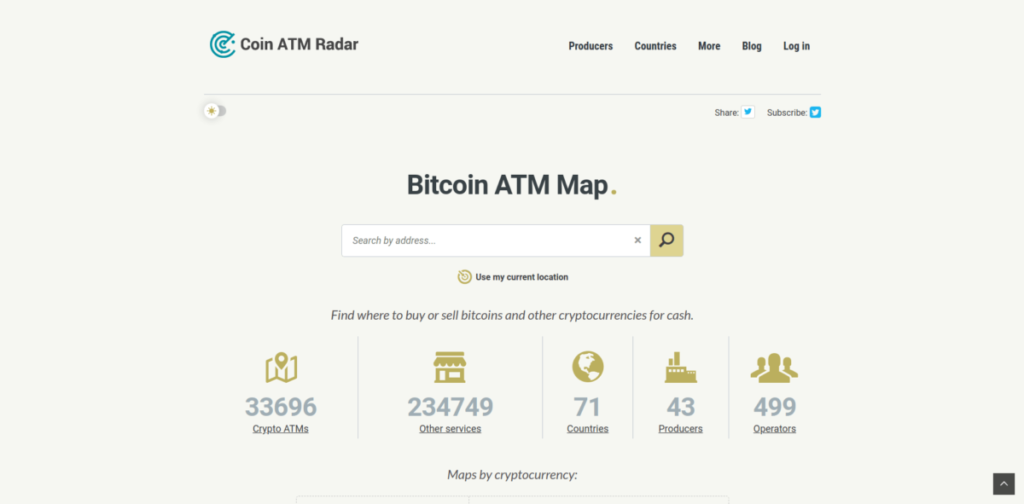

- Locate a Bitcoin ATM: The first step is to find a nearby Bitcoin ATM. Websites such as CoinATMRadar can be used to locate one. Users simply enter their location and the site provides a list of the nearest ATMs.

- Verification Process: Most ATMs require some level of identity verification. This could range from inputting a phone number to scanning an ID. The level of verification typically correlates with the amount of Bitcoin being purchased.

- Scan Wallet Address: To deposit the purchased Bitcoin, the ATM will ask for the user's wallet address. This is usually done by scanning the QR code on the user’s mobile wallet app.

- Insert Cash: After the wallet address has been validated, users can insert their cash into the machine.

- Confirm Transaction: The ATM will display how much Bitcoin will be sent based on the current exchange rate and fees associated with the transaction. If this is acceptable, users can confirm their transaction and wait for their Bitcoin to be transferred into their wallet.

Finding nearby Bitcoin ATMs

One of the primary ways to locate nearby Bitcoin ATMs is through online resources like CoinATMRadar. These platforms provide detailed information about the location of Bitcoin ATMs, including their exact address, operating hours, fees and transaction limits.

Steps to buy Bitcoin at an ATM using cash

- Step 1: Locate a nearby Bitcoin ATM using online resources or mobile apps.

- Step 2: Prepare your Bitcoin wallet by ensuring it is ready to receive funds.

- Step 3: At the ATM, follow the prompts on the screen for verification. This could involve submitting a phone number or scanning an ID.

- Step 4: Scan the QR code of your wallet address at the machine.

- Step 5: Insert your cash into the machine.

- Step 6: Confirm the transaction details as displayed by the ATM.

- Step 7: Wait for confirmation that your Bitcoin has been transferred to your wallet.

In essence, Bitcoin ATMs offer a physically accessible, user-friendly method of buying Bitcoin with cash. With more than 10,000 machines installed worldwide and growing every day, these ATMs bridge the gap between traditional finance and digital currencies. They allow anyone to join the crypto revolution, one bill at a time.

Factors to Consider When Using Bitcoin ATMs:

While BTMs offer an easy method of acquiring Bitcoins with cash, it’s important to consider several factors:

- Transaction Fees: BTMs often charge high transaction fees ranging from 5% to 10% per transaction. Ensure to verify the fees before proceeding.

- Price Volatility: Bitcoin prices can be volatile. It's advisable to check the current price on a trusted exchange platform against the price offered by the BTM.

- Security: Although BTMs offer anonymity, they are not entirely immune to cyber threats. Always opt for BTMs from reputable operators and in secure locations.

- Transaction Limits: Some BTMs may impose transaction limits depending on local regulations and operator's policies. Check these limits beforehand.

- Regulations: Bitcoin is regulated differently in various countries, affecting how BTMs operate. Be aware of the rules governing Bitcoin usage in your jurisdiction.

Navigating the Bitcoin landscape doesn't have to be daunting. With this guide, purchasing Bitcoins at a Bitcoin ATM can be as simple as withdrawing cash from a traditional ATM. While there are numerous ways to buy Bitcoins with cash, understanding each method's intricacies helps you make informed decisions and harness the power of this transformative technology.

2. AgoraDesk: A Comprehensive Guide for Cash Transactions

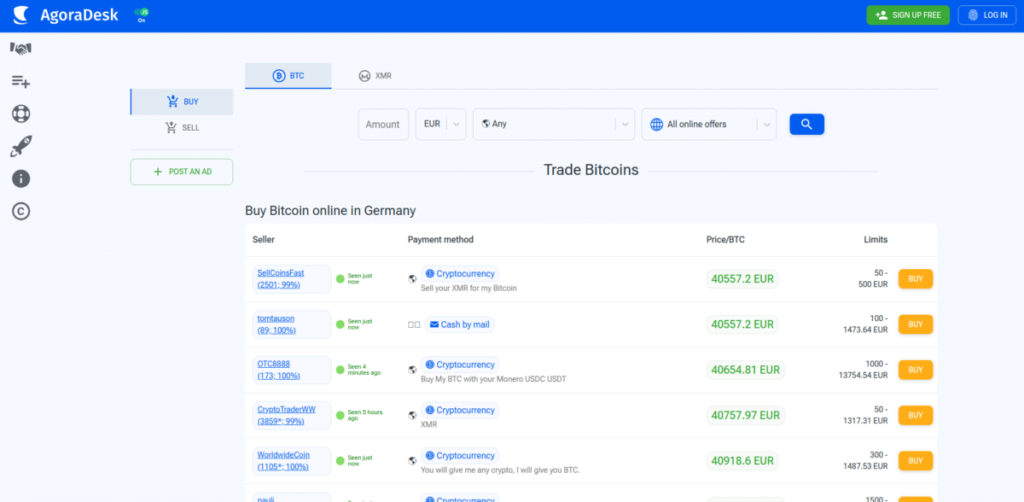

Diving into the world of cryptocurrency, AgoraDesk emerges as a pivotal player in the Bitcoin market, especially for those looking to transact with cash. Catering to a global user base, this platform offers an array of options for purchasing Bitcoin with cash.

Understanding AgoraDesk

AgoraDesk is a peer-to-peer (P2P) exchange platform. It offers a wide range of payment options, including cash transactions. One of the salient points about AgoraDesk is its commitment to privacy. The platform does not mandate KYC (Know Your Customer) verifications, thus preserving the anonymity of its users.

Features and Security Measures

AgoraDesk boasts several key features that make it a go-to choice for cash transactions:

- Anonymity: No mandatory KYC checks.

- Variety of Payment Options: Offers multiple ways to buy Bitcoin with cash, including face-to-face trades and cash by mail.

- Global Reach: Available worldwide, making it accessible to users across the globe.

- Flexible Pricing: Allows users to set their own exchange rates.

Alongside these features, AgoraDesk also takes strong measures to ensure the security of transactions on its platform:

- Escrow Service: Provides an escrow service that holds the seller's Bitcoins until the buyer's payment is confirmed.

- Dispute Resolution System: In case of any disagreements between buyers and sellers, an effective dispute resolution system is in place.

Cash by Mail Option on AgoraDesk

One unique feature of AgoraDesk is its ‘Cash by Mail' option – a method rarely found in other platforms. This method involves sending physical currency through mail to purchase Bitcoins.

Here are the steps involved:

- Choose a seller who accepts cash by mail.

- Confirm the trade details and initiate the transaction.

- Once the trade is initiated, the seller's Bitcoins are locked in escrow.

- The buyer sends the agreed amount of cash via registered mail to the seller's address.

- Upon receiving and verifying the payment, the seller releases the Bitcoins from escrow to the buyer's wallet.

While this method offers a high degree of privacy, it also requires trust between parties due to potential risks such as mail theft or loss. It is recommended to use registered mail for proof of payment.

AgoraDesk is indeed a compelling platform for purchasing Bitcoin with cash. Its commitment to user privacy, coupled with an array of payment options and strong security measures, make it a reliable choice.

Step-by-Step Guide to Purchasing Bitcoin with Cash on AgoraDesk

1. Registration: Sign up for an account on AgoraDesk. The process is straightforward and only requires an email address for verification.

2. Search for Offers: After logging in, navigate to the ‘Buy' page and set the search parameters. Choose ‘Cash' as the payment method, input your location, then click ‘Search'.

3. Select an Offer: Explore the list of offers available and select one that suits your requirements best. Pay attention to the seller's reputation score and trade history.

4. Open Trade: Once you've found a suitable offer, click ‘Buy' to open a trade.

5. Payment: Agree on a meeting place with the seller for the cash exchange or opt for a cash-by-mail transaction if it suits both parties.

6. Confirmation: After completing the cash exchange, confirm payment on AgoraDesk – this will release the escrowed bitcoins into your account.

Key Tips for Safe and Successful Transactions on AgoraDesk

- Anonymity: While conducting transactions on AgoraDesk, remember that maintaining anonymity is crucial—never disclose any personal information unnecessary for the trade.

- Escrow Service: Always use AgoraDesk's escrow service—it locks the bitcoins until you confirm receipt of cash payment, ensuring a secure transaction.

- Seller Reputation: Avoid new or unverified sellers. Stick to experienced traders with positive feedback and a good reputation score.

- Meeting Place: If opting for a face-to-face cash transaction, choose a busy public place for added security.

- Payment Confirmation: After handing over the cash, don't forget to confirm the payment on AgoraDesk—this will release the bitcoins from escrow into your wallet.

In your journey through the crypto world, AgoraDesk serves as an excellent platform for buying Bitcoin with cash. Embrace this secure and anonymous method of trading and unlock the potential of your digital assets.

3. LocalCoinSwap: Buying Bitcoin with Cash Made Easy

LocalCoinSwap is a cryptocurrency exchange that offers a unique approach to buying Bitcoin with cash. Unlike traditional exchanges, LocalCoinSwap operates as a peer-to-peer marketplace, connecting buyers and sellers directly. This platform has gained popularity among individuals who value privacy and want to avoid the hassle of KYC (Know Your Customer) verification. In this section, we will explore why LocalCoinSwap is a great choice for cash purchases and provide a step-by-step guide on how to use it.

Why Choose LocalCoinSwap for Cash Purchases?

Here are some reasons why LocalCoinSwap is worth considering if you're planning to buy Bitcoin with cash:

- Privacy: With LocalCoinSwap, you don't need to go through the process of submitting personal identification documents. Your privacy is respected.

- Diversity of Payment Methods: LocalCoinSwap supports various payment options, including bank transfers, cash deposits, and even cash by mail. This flexibility makes it easier for users to find a method that suits their needs.

- Escrow Protection: To ensure the safety of funds during transactions, LocalCoinSwap uses an escrow system. This means that the seller's Bitcoin is held in a secure account until both parties have fulfilled their obligations.

- Accessibility: LocalCoinSwap is available globally, allowing users from different countries to participate in cash trades without geographical limitations.

Conducting a Cash Trade on LocalCoinSwap: A Step-by-Step Process

If you're ready to start buying Bitcoin with cash using LocalCoinSwap, follow these steps:

1. Create an Account

- Visit the LocalCoinSwap website.

- Sign up by providing your email address and creating a password.

2. Search for Offers

- Click on the “Buy Bitcoin” button.

- Use the filters to narrow down the results and select “Cash” as the payment method.

- Browse through the list of sellers offering Bitcoin for cash.

3. Select an Offer

- Review the terms presented by each seller, including their price and preferred transaction method.

- Choose an offer that fits your requirements.

4. Begin the Trade

- Enter the amount of Bitcoin you want to buy.

- Initiate the trade, which will move the seller's Bitcoin into escrow.

5. Communicate with the Seller

- Use LocalCoinSwap's chat system to discuss further details with the seller.

- If you're planning for an in-person exchange, arrange a meeting place and time.

- For cash by mail transactions, follow the seller's instructions carefully.

6. Complete the Transaction

- For in-person trades, meet with the seller at the agreed-upon location and finalize the exchange.

- If using cash by mail, send your payment via registered post and keep proof of postage.

7. Confirm Receipt

- Once the seller receives your cash payment, they will release the Bitcoin from escrow into your wallet.

- Take a moment to verify that you have received the correct amount of Bitcoin before proceeding.

8. Leave Feedback

- After successfully completing a trade, leave feedback for your trading partner based on your experience.

The built-in escrow service provided by LocalCoinSwap adds an extra layer of security to each transaction. It ensures that both parties fulfill their obligations before funds are released, reducing the risk of scams or fraudulent activities. This feature has been instrumental in building trust within the LocalCoinSwap community.

When using LocalCoinSwap or any platform that facilitates buying Bitcoin with cash, it's important to exercise caution and follow best practices:

- Do thorough research on the reputation of the trader you're dealing with.

- Familiarize yourself with the platform's guidelines and policies.

- Stick to the agreed-upon terms and conditions for each trade.

Key Tips for Successful Cash Transactions

- Understand Local Regulations: Ensure that all trades comply with local laws and regulations.

- Stay Safe: Always meet in well-lit public places, preferably during daylight hours. If possible, bring a friend along for added security.

- Verify Transaction: Double-check that the Bitcoin has been sent to your wallet before releasing the escrow.

- Use Escrow Service: LocalCoinSwap provides an escrow service that holds the Bitcoin until both parties confirm the completion of the transaction. This reduces the risk of fraud and ensures a safe trade.

By offering a wide range of payment methods, prioritizing user privacy, and maintaining a focus on security, LocalCoinSwap has become a go-to platform for individuals who want to embrace the world of cryptocurrency without compromising their personal information or dealing with complex banking systems.

4. Hodl Hodl

In the realm of peer-to-peer (P2P) Bitcoin exchanges, Hodl Hodl stands out with its unique approach to cash transactions. This global non-custodial platform offers an effective way for users to buy Bitcoin with cash, ensuring safety and privacy at all times.

Unlike conventional cryptocurrency exchanges, Hodl Hodl does not hold user funds in their system. This non-custodial feature means that the control of your Bitcoin always remains in your hands during transactions.

How does it work?

During a trade, the seller's Bitcoins are locked in a multisig escrow wallet. The buyer then sends the agreed cash amount directly to the seller. Once the seller confirms receipt of payment, they can release the Bitcoins from escrow directly to the buyer's wallet.

With this process, Hodl Hodl acts as a mediator, providing a secure platform for trading while never taking control of your assets.

Buying Bitcoin on Hodl Hodl

Navigating the world of cryptocurrency can be challenging, but buying Bitcoin with cash on Hodl Hodl's P2P marketplace simplifies the process. This section will guide you through the step-by-step process and highlight the benefits of using Hodl Hodl's multi-signature escrow.

1. Creating an Account

- To start, create an account on Hodl Hodl by providing basic information. The platform offers a high level of privacy, allowing users to register without submitting extensive personal details.

2. Locating a Seller

- Once your account is set up, you can commence the search for a suitable seller. Use the filter options to find sellers who accept cash payments and are located in your region.

3. Initiating a Trade

- After identifying a suitable seller, initiate a trade by entering the amount of Bitcoin you wish to purchase and selecting your preferred payment method (in this case, cash). Click ‘Send trade request’ to start the transaction.

4. Payment Details

- The seller will provide payment details, including the location for an in-person exchange or instructions for a cash deposit into their bank account.

5. Confirming Payment

- Once payment has been made, click ‘Mark as paid’. This notifies the seller that they should release the Bitcoin held in escrow.

6. Receiving Bitcoin

- After confirming receipt of payment, the seller releases the Bitcoin from escrow. The funds will then appear in your wallet on Hodl Hodl.

While executing these steps, it is essential to consider security measures. Although transactions are safe due to Hodl Hodl’s multi-signature escrow system, physical exchanges should be conducted in public places for added safety.

Benefits of Using Hodl Hodl's Escrow Service

Hodl Hodl's escrow service brings several advantages to the table for cash transactions:

- Security: The use of multisig (multisignature) escrow wallets adds an extra layer of security. In this setup, two out of three keys are required to move the funds: one held by the buyer, one by the seller, and one by Hodl Hodl. This ensures that no single party has full control over the funds during the transaction.

- Privacy: Unlike many other platforms, Hodl Hodl does not require rigorous KYC/AML checks. While this might limit access to certain payment methods or regions due to local regulations, it offers a higher degree of privacy for those looking to buy Bitcoin with cash.

- Flexibility: With its global reach and support for various payment methods including cash deals, users have multiple options for trading. This flexibility allows users to choose the method that suits their needs the best.

- Control: As a non-custodial exchange, Hodl Hodl empowers its users with full control over their funds during transactions. This reduces the risk of loss due to hacking or platform downtime.

This guide provides a clear path towards purchasing Bitcoin on Hodl Hodl’s platform. By following these steps, you can navigate through the process with ease and security.

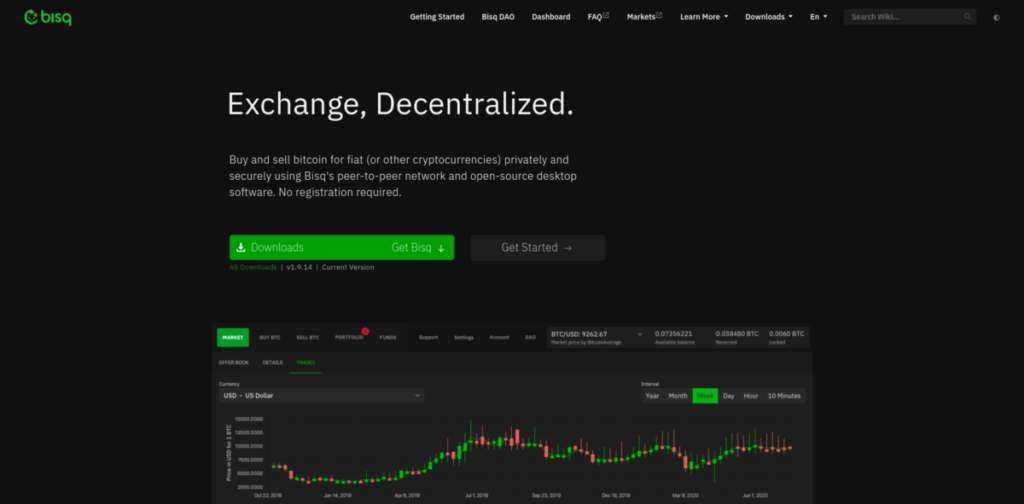

5. Bisq: The Decentralized Exchange for Buying Bitcoin with Cash

In the quest for financial sovereignty, Bisq stands out as a key player in the cryptocurrency realm. This decentralized peer-to-peer exchange operates with an emphasis on privacy and security, making it a preferred choice for individuals who want to buy Bitcoin with cash.

Decentralization and Privacy: How Bisq Stands Out

Bisq's defining characteristic is its decentralized nature. Unlike many exchanges that operate on centralized servers, Bisq runs on a global peer-to-peer network over Tor. This means there's no single point of failure or centralized entity that can be targeted by hackers or coerced by authorities.

Bisq's commitment to decentralization extends further than its robust infrastructure. It also applies to identity verification procedures. Traditional exchanges often require extensive Know Your Customer (KYC) checks, which can compromise user privacy. However, Bisq doesn't have such requirements. No personal data is stored on any server – all trading data is stored locally on the user's device and transmitted directly to the trading partner over Tor.

Buying Bitcoin with Cash on Bisq: A Different Approach

Buying bitcoin with cash on Bisq is not as straightforward as other methods due to its emphasis on privacy and decentralization. The platform allows for face-to-face trades where buyers and sellers can meet in person to exchange cash for bitcoins.

To initiate a trade, users publish their offer or respond to one already available. Once the trade is initiated, both parties' bitcoin is locked in a multi-signature escrow until the seller confirms receipt of the buyer's payment.

Pros of Buying Bitcoin with Cash on Bisq

- High level of privacy: Users don't need to provide any personal information other than their payment details.

- Decentralized: As there's no central authority, it's harder for transactions to be censored or funds frozen.

- Secure: All trades are protected by an escrow service.

Cons of Buying Bitcoin with Cash on Bisq

- Not as user-friendly: The platform's interface and procedures can be complex for beginners.

- Lower liquidity: As a decentralized exchange, it may have fewer users and thus less liquidity compared to centralized exchanges.

- Slow transactions: Transactions can take longer due to the manual process involved.

How to Buy Bitcoin on Bisq

Bisq stands out among cryptocurrency exchanges because of its decentralized nature. With Bisq, you can maintain your privacy while conducting cash trades for Bitcoin. Let's take a look at the process of purchasing Bitcoin using cash on Bisq.

Step-by-step Guide: Buying Bitcoin on Bisq with Cash

- Download and Install Bisq: Visit Bisq's official website and download the version that matches your operating system. Once the download is complete, follow the installation instructions.

- Create a New Account: Launch the application and go to the “Account” section. Click on “Add new account” and choose “Face-to-Face” as the payment method.

- Post a New Trade: Select “Sell BTC” and enter the details of your trade, including the amount, price, and location. Be clear in your trade description about the instructions for the face-to-face meeting.

- Wait for a Buyer: After posting your trade, wait for a buyer to accept it. You will receive a notification when someone takes up your offer.

- Complete the Trade: Arrange a meeting with the buyer at a public place. Once you have received the cash, confirm it in Bisq to release the bitcoins from escrow.

Remember, always prioritize your safety during face-to-face transactions.

Understanding How Bisq's Trade Protocol Works

Bisq operates on a peer-to-peer network, which means that transactions happen directly between users without any middleman involved. To ensure trust and security, Bisq utilizes a decentralized arbitration system and a security deposit model.

Here's how it works when you initiate a trade on Bisq:

- Both parties place a security deposit in Bitcoin.

- The seller puts their Bitcoin in a multisig escrow.

- Once both parties confirm that the transaction has been completed successfully, the escrowed funds are released.

- If there is any dispute during the trade, Bisq's decentralized arbitration system comes into play.

How Disputes are Resolved on Bisq

If there are any disagreements during a trade, users have the option to start a dispute. A mediator is assigned to investigate the issue, considering the evidence provided by both parties. If the mediator is unable to resolve the dispute, it gets escalated to an arbitrator. The arbitrator has the final decision-making authority in resolving the conflict, and their ruling is binding.

Key Tips for Safe and Successful Transactions on Bisq

- Privacy: Be cautious about sharing specific details of your face-to-face meeting publicly. Instead, communicate such information privately with your trading partner.

- Safety: Select a public location for your transactions.

- Verify: Always double-check the cash amount before releasing Bitcoin from escrow.

- Security Deposit: Keep in mind to allocate funds for the security deposit when setting up a trade.

Buying Bitcoin with cash on Bisq offers a unique combination of decentralized exchanges and cash transactions. It brings together the advantages of privacy, control, and freedom from traditional financial systems while ensuring secure transactions.

Advantages and Risks of Buying Bitcoin with Cash

When it comes to purchasing Bitcoin, cash transactions offer several compelling benefits. The foremost advantage is the privacy it affords. You don't need to reveal your banking or credit card information, safeguarding your personal data against potential risks. Cash transactions also eliminate the need for an internet connection, making Bitcoin accessible even in areas with limited online infrastructure.

Advantages of Buying Bitcoin with Cash

- Privacy: No need to reveal sensitive financial information.

- Accessibility: Purchase Bitcoin even without an internet connection.

However, buying Bitcoin with cash also brings certain risks. One of the main challenges lies in the physical security during a cash transaction. Meeting with a seller in person can pose safety concerns, which necessitates arranging such encounters in public and well-lit spaces.

Risks of Buying Bitcoin with Cash

- Physical Security: Safety concerns when meeting with sellers.

Moreover, there's a risk associated with the lack of traceability. If something goes wrong during the transaction, proving that payment was made can be difficult since cash leaves no digital footprint.

- Traceability: Difficulty in proving payment if issues arise.

To mitigate these risks, it's crucial to use platforms that have robust security measures in place. For instance, using an escrow service can provide a layer of protection for both buyers and sellers. Additionally, always verify a seller's reputation and history before conducting trades. This careful approach helps ensure a successful and secure Bitcoin purchase with cash.

Future of Buying Bitcoin with Cash

As cryptocurrencies continue to evolve, the landscape for buying Bitcoin with cash is expected to transform as well.

Emerging Trends

One of the emerging trends is the proliferation of Bitcoin ATMs. These machines are popping up in convenience stores and shopping malls, making it easier for individuals to buy Bitcoin using cash. The number of Bitcoin ATMs is predicted to rise significantly in the coming years given their ease of use and accessibility.

The expansion of peer-to-peer (P2P) marketplaces like AgoraDesk, LocalCoinSwap and Hodl Hodl also signals a promising future for cash transactions. With the added layer of privacy and security these platforms offer, buying Bitcoin with cash becomes even more appealing.

Prospects

Moving forward, technological advancements may pave the way for more efficient and secure cash transactions. For instance, blockchain technology can potentially be leveraged to track and verify cash payments, reducing the risk of fraud.

Challenges

On the flip side, regulatory challenges might pose a hurdle. As governments around the world grapple with how to regulate cryptocurrencies, this could impact how one can purchase Bitcoin with cash.

Despite these obstacles, the future looks bright for those who prefer to buy Bitcoin with cash. The evolving crypto ecosystem is likely to continue developing mechanisms that make such transactions simpler, more secure and more accessible.

Conclusion

The landscape of cryptocurrency is always changing, with the pursuit of financial freedom at its core. Buying Bitcoin with cash is a prime example of this pursuit, providing privacy and control in an ecosystem where these values are essential. The guide we've presented offers various ways to acquire Bitcoin using cash, each with its own advantages designed to meet different needs.

Here are some key takeaways:

Explore the convenience of Bitcoin ATMs for quick transactions.

These machines allow you to buy Bitcoin instantly using cash, making them a popular choice for those seeking convenience.

Navigate platforms like AgoraDesk or LocalCoinSwap for personalized trade experiences.

These platforms connect buyers and sellers directly, allowing you to negotiate prices and choose payment methods that suit you best.

Embrace the security of decentralized exchanges such as Hodl Hodl and Bisq, which put privacy at the forefront.

Decentralized exchanges don't hold your funds or personal information, giving you more control over your trades while prioritizing privacy.

As you enter the world of Bitcoin, let these options guide you towards a method that fits your preferences. Whether it's the speed of a local ATM or the careful process of P2P exchanges, there's a path for everyone.

Remember, knowledge alone is not power—it's action that brings about change. Start your journey into cryptocurrency today by acquiring Bitcoin with cash and become part of the movement towards a more private and secure financial future.

FAQs (Frequently Asked Questions)

What are the advantages of choosing cash transactions when buying Bitcoin?

Cash transactions offer anonymity, as they do not require the disclosure of sensitive financial information. They also provide a quick and convenient way to acquire Bitcoin without the need for bank accounts or credit cards.

How do Bitcoin ATMs work?

Using a Bitcoin ATM involves a few simple steps: Locate a Bitcoin ATM, verify your identity (if required), select the amount of Bitcoin you want to buy, insert cash, and then confirm the transaction. The purchased Bitcoin will be sent directly to your digital wallet.

What is AgoraDesk and how does it work for cash transactions?

AgoraDesk is a peer-to-peer exchange platform that allows users to buy and sell Bitcoin with cash. It offers features such as ‘Cash by Mail' option for secure transactions and provides a comprehensive guide for conducting cash trades.

Why should one consider using LocalCoinSwap for cash purchases of Bitcoin?

LocalCoinSwap offers a unique platform for buying Bitcoin with cash, providing a step-by-step process for safe and successful transactions. It also connects buyers and sellers directly, allowing personalized trade experiences.

What are the benefits of using Hodl Hodl's escrow service?

Hodl Hodl's escrow service brings several advantages to the trading process, including security for both buyers and sellers, as well as protection against potential disputes during the transaction.