How to Accept Bitcoin as a Business in 2025: A Step-by-Step Guide

Introduction

As we dive deeper into the digital age, Bitcoin's popularity continues to rise, indicating a significant change in how we handle money. In 2025, Bitcoin is no longer just a topic discussed by tech enthusiasts and investors; it has become a global force, reshaping how businesses exchange value. Accept Bitcoin as a Business is not just something you might consider; it is becoming essential for companies that want to stay ahead.

What You'll Learn in This Guide

In this guide, we will explore everything you need to know about accepting Bitcoin as a business. Here are the topics we'll cover:

- Setting Up Your Self-Hosted Merchant Account: Step-by-step instructions on creating a merchant account tailored for Bitcoin payments.

- Integrating Other Payment Processors: An overview of other popular payment processors like Coingate, Coinpayments and Blockonomics and how to integrate them into your website or store.

- Exploring Alternative Solutions: A look at other options such as NowPayments and CoinRemitter for accepting Bitcoin.

By the end of this guide, you'll have all the knowledge and tools necessary to start accepting Bitcoin confidently, giving your business a competitive edge in the ever-changing landscape of digital payments.

Why Accept Bitcoin?

As we approach 2026, businesses are considering the possibilities that Bitcoin offers. Let's explore the key benefits of accepting Bitcoin and how it can positively impact your business.

Advantages of Accepting Bitcoin

Lower Transaction Fees

- Traditional payment systems often have high fees, which can eat into profits.

- Bitcoin transactions bypass these costly fees, providing a more cost-effective solution.

- By embracing Bitcoin, businesses can keep more of their earnings.

Faster and Easier Cross-Border Transactions

- Bitcoin's borderless nature makes it ideal for international transactions.

- Payments can be made quickly, without the delays typical of traditional banking methods.

- This speed opens up opportunities to reach customers worldwide.

Increased Security and Privacy

- The encryption used in Bitcoin transactions adds an extra layer of security against fraud.

- Both businesses and customers appreciate the enhanced privacy that Bitcoin offers.

- The decentralized nature of Bitcoin reduces the risks associated with centralized financial institutions.

Potential for Value Growth

- Due to its limited supply, Bitcoin is often compared to digital gold with potential for appreciation.

- Businesses that accept and hold Bitcoin may see their holdings increase in value over time.

- This unique feature makes Bitcoin not just a payment method but also a potential investment.

By looking ahead, we can better understand where commerce is heading. As we move on to discussing how to set up a Bitcoin merchant account, remember these compelling reasons why integrating Bitcoin into your business isn't just an option—it's a strategic move for those looking to stay ahead in their industries.

Setting Up a Bitcoin Merchant Account

Engaging with the digital economy necessitates modern solutions, and setting up a Bitcoin merchant account is your gateway to financial autonomy. Freed from the shackles of third-party intermediaries, businesses can now accept Bitcoin payments directly, ensuring swift transactions and bolstering their bottom line.

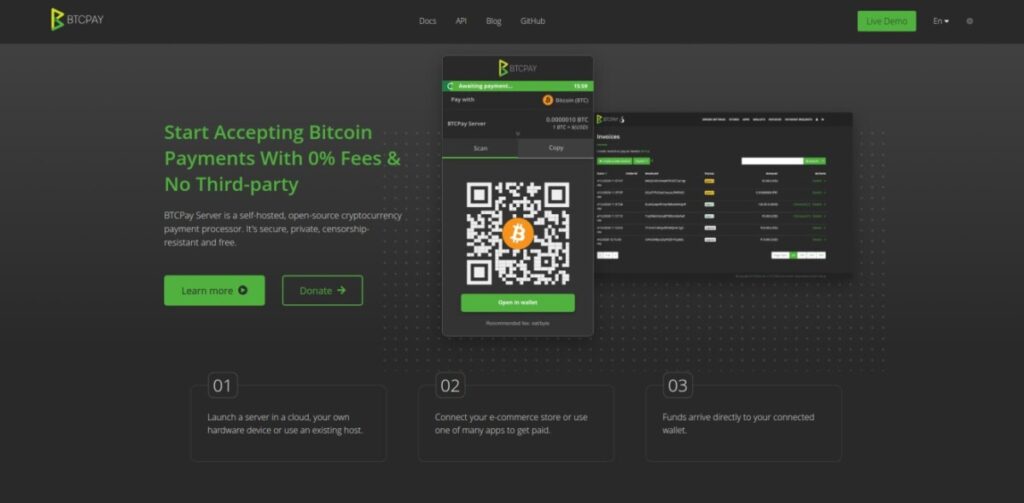

BTCPay: An Open-Source, Self-Hosted Bitcoin Payment Processor

BTCPay Server is a shining example of decentralization in the payment processing universe. As an open-source, self-hosted payment processor, it gives merchants an unmatched level of control over their transactions—a crucial element in today's dynamic and fast-paced digital economy. Here's a quick guide on how to harness its potential:

Step-by-Step Guide to BTCPay Setup:

1. Create Your BTCPay Server Account

Kickstart your journey by visiting the official BTCPay Server website. You'll find a ‘Get Started’ button on the home page that will guide you through the account creation process. The step-by-step instructions are designed to be user-friendly, helping you set up your account swiftly and efficiently.

2. Deploy Your Instance

Next, you'll need to deploy your instance—essentially setting up your server. Choose a hosting method that aligns with both your technical prowess and specific business requirements. The options run the gamut from third-party hosting providers for those seeking ease and convenience, to self-hosting for businesses prioritizing maximum privacy and control.

3. Configure Your Store

Once your server is up and running, navigate to the ‘Stores' section located in the dashboard. Select ‘Create a new store' to start customizing your store settings. This includes wallet setup, where you'll have the option to link your existing Bitcoin wallet or generate a new one if you're just starting out with cryptocurrency.

4. Integrate BTCPay with Your Website

To make Bitcoin payments a reality for your customers, integrate BTCPay into your online store. The platform provides plugins or API integrations that are compatible with popular e-commerce platforms like WooCommerce, Shopify, and Magento—making this process seamless and straightforward.

5. Test The Payment Process

Before going live, it's pivotal to ensure everything is working smoothly. You can do this by conducting test transactions using BTCPay's built-in invoice system. This helps identify and rectify any potential issues, ensuring your customers enjoy a flawless shopping experience.

Why Choose BTCPay?

BTCPay Server brings several benefits to the table, making it an excellent choice for businesses keen on embracing Bitcoin payments:

- Direct Payments: Transactions are sent straight into your wallet—no intermediaries, no fuss.

- Enhanced Security: With full custody of your funds, you're not reliant on external parties—boosting security.

- Reduced Costs: Cut down on extra fees that are commonplace with third-party processors.

- User Privacy: Customers can make transactions confidentially without having to expose sensitive information—a big plus in today's privacy-conscious world.

- Flexibility: Support for various cryptocurrencies extends beyond just Bitcoin—opening up more possibilities for your customer base.

- Community Support: Access a vibrant community and comprehensive documentation for troubleshooting.

By choosing BTCPay, businesses can take a massive leap towards financial sovereignty. The platform does more than just simplifying transaction management—it builds trust through transparency and security, pillars of any successful digital enterprise.

Get your BTCPay up and running today for a leap towards financial sovereignty

CoinGate: A Comprehensive Payment Processor

One payment processor that stands out for businesses interested in accepting Bitcoin is CoinGate. It combines the convenience of traditional payment methods with the innovative nature of cryptocurrency transactions.

Key Features of CoinGate:

- Versatility: Supports multiple cryptocurrencies, not just Bitcoin.

- User-Friendly: Provides a smooth interface for both merchants and customers.

- Security: Implements strong measures to ensure transaction safety.

- Conversion Options: Allows conversion to regular currencies, reducing risks related to price fluctuations.

Setting Up a CoinGate Account

To make use of CoinGate for your business, follow these steps:

- Register Your Business Account

- Go to the CoinGate website.

- Click on “Sign Up” and choose the “Business” account type.

- Fill in your business information and verify your email address.

- Verify Your Business

- Submit the required documents for business verification.

- Complete any Know Your Customer (KYC) procedures as per regulatory requirements.

- Integration Options

- Decide how you want to integrate CoinGate:

- Utilize plugins designed for eCommerce platforms like WooCommerce or Shopify.

- Make use of APIs for custom integration into your website or application.

- Customize Your Payment Gateway

- Set your preferred currencies and payout options.

- Personalize the appearance of your payment gateway to match your brand.

- Go Live and Test

- Activate your account settings.

- Conduct test transactions to ensure everything is functioning correctly.

Leveraging CoinGate for Your Business

By incorporating CoinGate into their operations, businesses can enjoy several advantages:

- Global Reach: Easily access customers from around the world.

- Reduced Costs: Benefit from lower fees compared to credit card processors.

- Speed: Enjoy fast transaction confirmations.

- Enhanced Privacy: Provide customers with an extra layer of privacy in their transactions.

This way, businesses can make use of the benefits mentioned above while still offering their customers a familiar checkout experience. The process of shifting from traditional payments to accepting Bitcoin becomes less intimidating, allowing businesses to stay competitive in the digital economy.

Understanding payment processors like CoinGate helps us see how they contribute to wider acceptance of Bitcoin across various industries. They simplify the entry into the world of cryptocurrencies for businesses all over the globe.

Get started with accepting payments through Coingate today

CoinPayments: A Comprehensive Multi-Cryptocurrency Platform

CoinPayments, a Canadian-based payment processor established in 2013, provides a multitude of plugins, APIs, and POS interfaces primarily designed for merchant users. It enables merchants to sell, purchase, and exchange digital assets, as well as accept Bitcoin and over 1600 alternative cryptocurrencies as payment for various products and services. With more than 2,427,500 merchants across 182 countries, CoinPayments is the most comprehensive multi-cryptocurrency platform available.

Key Features of CoinPayments:

- GAP600 Instant Confirmations: Enhances the speed of Bitcoin transactions.

- Vault: Allows users to secure their coins in a cold wallet with a specified time period before spending.

- Fiat Settlements: Enables direct fiat settlements to bank accounts for merchants in the United States or Europe.

- Point of Sale (PoS): Provides an easy-to-use interface for in-person transactions that can be integrated into stores.

- AirDrops: Assists new projects in distributing coins and tokens to new users.

- Mobile Apps: Accessible on iOS and Android devices for on-the-go functionality.

- Auto Coin Conversions: Automates coin conversions to save time and fees.

- Multi-Coin Wallet: Hot wallet that allows storage and management of over 1600 altcoins.

Moreover, CoinPayments offers an API compatible with most current eCommerce platforms, including websites and mobile apps. Even without coding skills, one can easily integrate CoinPayments through dedicated plugins for platforms like opencart, magento, shopify, and woocommerce.

How to Accept Bitcoin using CoinPayments:

Establishing a CoinPayments account is straightforward – simply sign up on their website using an email address. After verifying the confirmation email received and logging in using the provided 2-FA authentication code, an inbuilt setup wizard will guide users through the CoinPayments dashboard. To accept merchant payments with CoinPayments, KYC verification must be completed. Then, choose either multiple coins or a single coin, such as Bitcoin (BTC).

Now, the account is ready to accept Bitcoin payments. For physical stores, this can be achieved by sending customers an email containing a payment link. For online transactions, use one of the listed plugins to provide customers with a unique QR code for each payment.

Upon receiving a Bitcoin payment, users have the option to:

- Retain bitcoins in their wallet for personal purchases.

- Convert bitcoin to fiat automatically and deposit it into their bank account.

These are just basic examples of how finances can be automated using Bitcoin. Depending on business needs, other methods include paying employee salaries, replenishing stock from suppliers when low, or settling bills in countries where it's permitted.

Sign up for CoinPayments today and start accepting cryptocurrencies.

Blockonomics: Your Non-Custodial Bitcoin Payment Gateway Solution

Blockonomics is a non-custodial Bitcoin payment gateway launched in 2015. Unlike Coinpayments, Blockonomics doesn't hold your funds but acts only as a service provider. Users can become their own banks by accepting Bitcoin directly to their own wallets. The Blockonomics service enhances the wallet's users already own. It is for those who want convenience but still retain 100% control over their coins.

Blockonomics Features

- No Documentation: No paperwork is required to start accepting payments.

- Merchant Integration: Accept bitcoin payments on your website.

- Payment Forwarding: Forward your payments to a chosen Bitcoin address.

- Fast and Segwit Ready: Get paid instantly, and forget about transfers or excessive fees.

- Direct to Wallet: Payments go directly to your wallet. 100% control over your own bitcoin.

- Decentralized: All major Bitcoin wallets like Electrum, Trezor, and Ledger are supported.

- P2P Anonymous Invoicing: Receive payments for your work using your own bitcoin address in a secure way.

Blockonomics also offers API integration with most eCommerce platforms. Alternatively, you can download a plugin for most common platforms such as WordPress OpenCart, and Magento.

In addition, Blockonomics offers wallet watchers to help you keep track of your balances and provides 24/7 customer support.

How to Use Blockonomics to Accept Bitcoin

Getting started with Blockonomics is fast and easy. Simply create an account on their website using an email and password. After confirming your email, log into your account.

Navigate to the Merchant tab where you will find an in-built Merchant Wizard, which will guide you through the setup process.

The merchant setup involves three steps, beginning with verifying your xpub key for your chosen wallet. After inserting the xpub key of your chosen wallet, you'll gain access to your API keys which can be integrated directly into your website using the plugins.

That's it! The bitcoins you receive will go directly to your wallet, and you can keep track of them using the wallet watcher service.

If necessary, Blockonomics also offers a forwarding service to automatically send your funds to the chosen exchange upon receipt of Bitcoins.

Create an account on Blockonomics and start accepting Bitcoin today.

Other Bitcoin Payment Processors to Consider

When it comes to Bitcoin payment solutions, there are other options to explore besides CoinGate. Businesses who want to accept cryptocurrency should take a look at these two alternatives:

NowPayments

NowPayments stands out for its versatility and user-friendly approach. Here's why it could be a good choice for you:

- Instant Auto-Conversion: If you're worried about Bitcoin's value changing too much, NowPayments can automatically convert your Bitcoin into regular money right away.

- Wide Range of Cryptocurrencies: NowPayments doesn't just support Bitcoin – they also work with many other types of cryptocurrencies, so you can reach even more potential customers.

- API and Invoicing Tools: It's easy to connect NowPayments with your existing systems thanks to their helpful tools for developers and creating invoices.

- Non-Custodial Service: Just like Blockonomics, NowPayments doesn't hold onto your money. Instead, they send it straight to your own wallet as soon as a payment is made.

CoinRemitter

CoinRemitter has some interesting features that set it apart from the competition:

- No KYC Requirements: If you want to get started quickly without having to go through any verification processes, CoinRemitter might be the right choice for you.

- Low Processing Fees: With fees as low as 0.23%, CoinRemitter aims to be an affordable option for businesses who want to keep their costs down.

- Wallet Integration: They work with many popular cryptocurrency wallets, making it easy for businesses who already use these services to start accepting payments.

- Plugins for E-commerce Platforms: CoinRemitter offers ready-made plugins for platforms like WooCommerce and Magento, which can save time and effort for online retailers.

Both NowPayments and CoinRemitter have created their services with specific challenges in mind, such as the unpredictable nature of cryptocurrency prices, the complexity of integrating crypto payments into existing systems, and the fees associated with transactions. By considering these factors and choosing the right payment processor, businesses can position themselves for success in the digital economy as Bitcoin continues to gain popularity worldwide.

For a comprehensive list of cryptocurrency payment gateways, visit Top Cryptocurrency Payment Gateways

Increasing Global Adoption of Bitcoin Through Merchant Acceptance

The surge in global adoption of Bitcoin is not just a fleeting trend but a testament to the currency's robustness and the forward-thinking nature of businesses worldwide. Eye-opening statistics reveal a consistent increase in the number of companies that now offer Bitcoin as a payment method. This wave of adoption spans from small startups to multinational corporations, all recognizing the strategic advantage of being part of the cryptocurrency ecosystem.

The Growth of Bitcoin Acceptance

In 2021, a mere 4% of small businesses in the United States accepted Bitcoin; fast forward to 2024, and this figure has seen a substantial increase. On an international scale, regions that once observed cryptocurrency with caution are now leading in adoption rates, with countries like El Salvador pioneering the charge as they officially adopt Bitcoin as legal tender.

Notable Companies Embracing Bitcoin

Illustrating this upward trajectory are several notable companies who have not only integrated Bitcoin but have also reaped significant benefits:

- Tesla made headlines when it announced it would accept Bitcoin for vehicle purchases, cementing its position as an innovator both on and off the roads.

- Square, known for revolutionizing mobile payments, expanded its portfolio by offering Bitcoin trading through its Cash App platform, serving as both a merchant and facilitator in the crypto space.

- Overstock, an e-commerce giant, became one of the first retailers to accept Bitcoin back in 2014 and has since reported consistent growth year over year.

These examples represent just a snapshot of the burgeoning embrace of digital currencies across various industries. They signal a future where Bitcoin is not an outlier but rather an integral part of global commerce.

With each business that opts to accept Bitcoin, the narrative shifts — cryptocurrency becomes less a speculative investment and more a staple in transactional operations. The message is clear: embracing Bitcoin is not merely about keeping up with trends; it's about setting them.

Conclusion

Embracing the future means adapting to change. With Bitcoin's meteoric rise, businesses find themselves on the precipice of a digital revolution.

Accepting Bitcoin as a business is not just a trend; it's an evolution in the world of commerce. It stands as a testament of adaptability, resilience, and foresight in facing the future of transactions.

Imagine a world where:

- transaction fees are lower,

- cross-border payments are faster, and

- security is heightened.

This is not just a fantasy; it's the reality that Bitcoin offers to businesses today.

The future of Bitcoin payments is here and now. As we stand at the dawn of 2026, there has never been a better time to join this movement. The benefits are evident, the process is simple, and the potential for growth is immense.

Have you imagined your business thriving amidst this digital revolution? Are you ready to harness the power of Bitcoin for your enterprise? Your journey starts with setting up that Bitcoin merchant account or integrating a payment processor into your system.

Take charge of your business' future today! Implement these strategies:

- Establish your merchant account with BTCPay.

- Integrate CoinGate or other viable payment processors like NowPayments and CoinRemitter into your operations.

Watch as your global reach expands.

Remember: The future belongs to those who prepare for it today. So start accepting Bitcoin with confidence and welcome the future of digital transactions in 2025 and beyond. You're not just adapting; you're pioneering!

FAQs(Frequently Asked Questions)

What will I learn in this guide?

In this guide, you will explore everything you need to know about accepting Bitcoin as a business in 2025, including the advantages of accepting Bitcoin, setting up Bitcoin merchant accounts, and using various Bitcoin payment processors.

Why should businesses consider accepting Bitcoin in 2025?

As we approach 2026, businesses are considering the possibility of accepting Bitcoin due to the increasing global adoption of Bitcoin through merchant acceptance and the notable companies embracing Bitcoin.

What are the advantages of accepting Bitcoin?

Some advantages of accepting Bitcoin include lower transaction fees compared to traditional payment systems, embracing decentralization in the digital economy, and leveraging modern solutions for engaging with the digital economy.

How do I set up a Bitcoin merchant account?

Engaging with the digital economy necessitates modern solutions such as setting up a Bitcoin merchant account. This guide will provide a step-by-step process for setting up a Bitcoin merchant account.

Why should I choose BTCPay as a Bitcoin payment processor?

BTCPay Server brings several benefits to the table, making it an attractive option for businesses interested in accepting Bitcoin. These benefits include being an open-source, self-hosted payment processor and providing modern solutions for engaging with the digital economy.