Master the Crypto Market: Your Ultimate Trading Handbook

Introduction

Every aspiring cryptocurrency trader needs a solid foundation. That's where the Master the Crypto Market: Your Ultimate Trading Handbook comes in. This comprehensive guide is your ticket to understanding the basics of trading with Bitcoin and other cryptocurrencies.

Fast Track Your Learning

Time is money, especially when you're planning to dive into the fast-paced world of crypto trading. Master the Crypto Market: Your Ultimate Trading Handbook is meticulously crafted to save you time by providing concise information that prepares you for your journey towards becoming a successful cryptocurrency trader.

What Will You Learn?

The guide covers a wide array of topics crucial to crypto trading:

- Getting Started: Learn where and how to kick off your trading journey. From setting up your first digital wallet to purchasing your initial batch of Bitcoin, we've got you covered.

- Understanding Market Movements: Grasp what influences market trends and how these factors can impact your trading decisions.

- Insights from the Experts: Benefit from key insights shared by seasoned traders, giving you an edge in this competitive landscape.

- Trading Tools: Discover essential tools that enhance efficiency and help in making informed decisions.

- Methodologies: Understand various trading strategies and methodologies – from day-trading to swing trading – and choose what suits your style best.

Remember: Trading & investing involves risks and profits are not guaranteed!

If you're brand new to Bitcoin, we recommend starting with the basics. Get a clear understanding of what Bitcoin is and why it's significant in today's financial landscape by reading our introductory article:

How Do I Begin My Journey With Bitcoin Trading?

Embarking on the journey of trading with Bitcoins is a significant decision. As the first step, it's crucial to acquire some amount of Bitcoin, which will be your primary tool in cryptocurrency trading. Since Bitcoin is still relatively new and characterized by its volatility, it's often considered a high-risk investment. Therefore, we recommend you to invest an amount that you can afford to lose, and maintain this separate from your personal funds.

Don't get fixated on the value of your bitcoins in terms of USD. We're here to increase our Bitcoin holdings, hoping they will appreciate over time. If you succeed as a trader, earning more dollars will naturally follow.

Acquiring Bitcoins

There are various ways to acquire Bitcoins, but the most convenient and quickest way is by purchasing them from a cryptocurrency exchange. Visit Leading Crypto Exchanges for an updated list of over 120+ exchanges or consider these options:

- Changelly: Ideal for purchasing Bitcoin using a credit card.

- CEX.IO: An old reliable exchange with worldwide coverage. Excellent for bank transfers.

- LocalCoinSwap: Best if you want to connect with local sellers anonymously and prefer to use physical cash.

Setting Up Your Trading Account

Once you've purchased your first Bitcoins, it's time to set up a Bitcoin trading account on one of the top margin trading exchanges like Bybit, Phemex, MEXC, or Huobi. Alternatively, trading stocks, forex, CFDs, commodities with Bitcoin is also an option on crypto brokers such as SimpleFX, and PrimeXBT.

Before you dive into trading, make sure you've read and understood all the relevant resources. Only then should you proceed with the steps to purchase your first Bitcoins.

Remember: Managing your own coins is serious business. You are quite literally your own bank, so it's crucial to learn how to secure and protect your private keys.

Not Your Keys, Not Your Bitcoins.

To understand the intricacies of the markets, what influences market movements, the difference between investing and trading, understanding margin, and more, continue reading further.

Deep Dive Into Financial Markets: Unmasking the Truth

The financial markets, at their very core, are an immense enterprise aimed at generating profits. This statement may appear to be a stark simplification, however, it underscores the fundamental truth of how these markets were intentionally crafted – to profit from the widespread lack of financial literacy.

The Impact of Financial Literacy on Wealth Distribution

If financial literacy was universally imparted as a standard part of education, we'd likely observe a more equitable wealth distribution worldwide. Unfortunately, the majority continue to remain oblivious about basic financial concepts such as how their everyday fiat currency is created and the intricate system that governs its operation.

The complexity inherent in these systems is not coincidental – it's deliberately engineered to be difficult to comprehend in order to maintain the status quo and prevent the masses from prospering.

The Educational Gap: The Missing Practical Knowledge

Hard as it may be to believe, a thorough examination of our educational systems exposes an alarming omission – practical knowledge for navigating the modern world is woefully lacking. Today's typical graduate often finds themselves ill-equipped with essential life skills such as:

- Filing taxes

- Setting up a business

- Understanding the basics of our monetary system.

Astoundingly, an average individual cannot define the properties of fiat currency; something they'll spend most of their life pursuing. Few question its inherent value or realize that fiat money is essentially created out of thin air.

From Barter System to Fiat Currency: The Evolution

Our education system does teach us about our evolution from a primitive bartering system to using precious metals like gold and silver, and then transitioning to our present-day fiat currencies. However, there's a significant gap in this narrative.

We're still essentially operating on barter principles; only now we do so in a more efficient manner.

This understanding illuminates how our financial systems have evolved over time and continue to shape our economy. By increasing financial literacy, we can empower individuals to make informed decisions about their money and ultimately contribute to a more balanced global wealth distribution.

Supply and Demand: A Basic Economic Principle

The Illusion of Value in Financial Markets

Financial markets are merely platforms for exchanging value. We've come a long way, from physically bartering items like livestock to now using digital devices for transactions in fiat currencies. It's easy to believe these currencies hold inherent value, but this is essentially an illusion – they operate on the same basic principles as they did thousands of years ago.

Value: A Matter of Perception and Supply-Demand Dynamics

Understanding what creates and influences value can be a game-changer. At its core, value is determined by supply and demand – a fundamental economic principle that dictates market trends. If an item or asset becomes scarce, its perceived value increases; conversely, if there's an abundance of it available, its value decreases.

Consider the case of diamonds – their exorbitant value is not inherently tied to their practical utility, aesthetic appeal, or even the common misconception of their rarity. Rather, it stems from a market heavily dominated by a select few entities. Conversely, water – an essential element for life – is often undervalued and taken for granted due to its widespread availability. Similarly, consider electricity, which seamlessly integrates with our modern world and is often overlooked because of its ubiquity. However, switch off the power and you'll quickly discover that in that particular moment, the humble candle holds significantly more value.

The Complicated World of Inflation and Fractional Reserve Banking

Many individuals grapple with complex concepts like inflation and fractional reserve banking. Banks possess the power to artificially create money, thus inflating the money supply. This process depreciates your currency's purchasing power. As a result:

Everything becomes more expensive over time.

Sound Money: Bitcoin and Precious Metals

Unlike fiat currencies, assets like Bitcoin and precious metals are considered ‘sound money'. They stand apart because:

- Their scarcity can be calculated

- This information is transparently available to everyone

These characteristics make them immune to the inflationary policies of central banks.

Lifelong Wealth Generation: Understanding Fiat Currency Depreciation

A fundamental understanding of how fiat currencies will continue to depreciate due to constant printing can be your key to lifelong wealth generation. As the saying goes:

Money flows from those who value it least to those who value it most.

In essence, valuing your money means understanding its nature, its vulnerabilities and the forces that can erode its purchasing power. Armed with this knowledge, you are better equipped to protect and grow your wealth.

Drivers of the Cryptocurrency Market: A Deeper Look

One of the fundamental principles in economics is the law of supply and demand. This foundational knowledge can help you understand market dynamics and leverage them to your advantage. However, to be truly successful in navigating the volatile landscape of the cryptocurrency market, you need to dig deeper and debunk a common misconception – price and value are not synonymous!

Imagine yourself stranded on a desert island. You have a hundred-dollar bill in your pocket, but there's no shop or restaurant around. In this situation, that bill won't buy you a quick meal, but it could be used to start a fire. This example demonstrates how context can drastically alter the perceived value of money. It also underscores that any event which adversely impacts our current monetary system could conversely benefit assets considered ‘sound money' such as cryptocurrencies or precious metals. To put it simply, value is what you get, price is what you pay.

Like all markets, cryptocurrencies are driven by supply and demand dynamics. But don't fall into the trap of assuming that positive news will always drive prices up – markets can remain irrational longer than you can stay solvent.

In order to navigate these tricky waters successfully, it's critical to understand some of the key factors that can impact cryptocurrency prices:

- Fear: Fear can wreak havoc on markets. For instance, rumors about stringent new regulations or potential security breaches can spark panic selling.

- Greed: On the flip side, greed can lead to speculative bubbles as traders rush to buy in hopes of quick profits.

- News events: Significant news events, whether positive or negative, have the power to cause sharp movements in cryptocurrency prices.

- Technological advancements: The release of new, innovative technologies or updates to existing platforms often leads to increased interest and demand for a particular cryptocurrency.

- Political situations: The political climate can greatly influence the cryptocurrency market. For instance, if a government decides to ban or heavily regulate cryptocurrencies, it may lead to a drop in prices.

- Government regulations: Changes in legal frameworks and regulatory policies can significantly impact cryptocurrency markets.

By understanding these factors and carefully monitoring market dynamics, you can make informed decisions about when to buy or sell your cryptocurrencies.

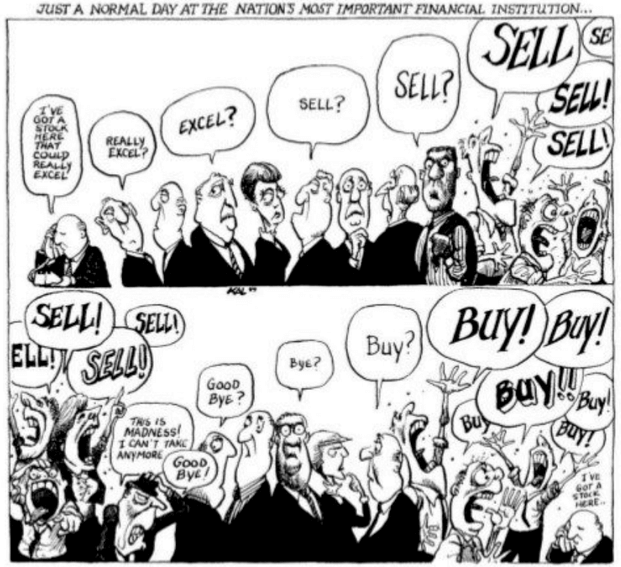

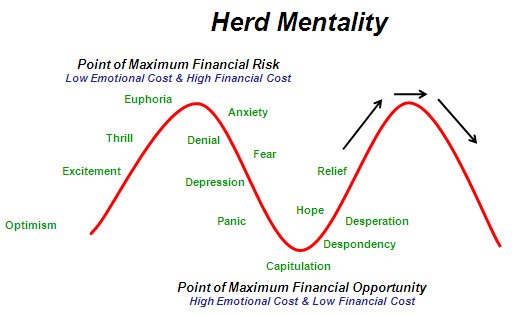

Understanding Human Psychology Through Trading Charts

In the world of trading, digital screen price charts are not just mere representations of numbers and figures. They are, in reality, a reflection of human emotions. As traders, we interact with these charts through our electronic devices, decoding what they represent and making decisions based on our interpretations.

“When you observe the prices on your screen, what you are actually seeing are human emotions represented in charts.”

This statement underscores the importance of human psychology in trading. The rise and fall of prices encapsulate the collective sentiments of traders worldwide – their fears, their hopes, their anticipations.

The Dichotomy of Market Movement

Trading charts present a two-dimensional view of market movement. They display an upward or downward trajectory at any given moment, creating a binary scenario for traders.

- The market is either going up.

- Or it's going down.

From this perspective, it appears that you have a 50/50 chance to predict the market's next move correctly.

However, this is a simplistic viewpoint. In reality, trading involves much more complexity and subtlety. It's worth noting that approximately 95% of retail traders lose money in the market. This statistic emphasizes the challenges inherent in trading and underscores the importance of leveraging more than just binary thinking.

Shifting Your Perspective for Long-Term Success

Adjusting your perspective can have profound implications for your long-term success in trading. At its core, trading isn't about predicting individual price movements but understanding the general sentiment of market participants.

“Trading is about understanding what the masses are thinking and positioning yourself on the right side of history.”

In essence, successful trading involves:

- Understanding collective market sentiment.

- Developing a robust trading plan.

- Implementing effective risk management strategies.

With these components in place, profiting from trading becomes less about luck and more about jumping from one opportunity to another, backed by sound strategy and understanding of market dynamics. By viewing trading charts as more than just numbers – as a reflection of human emotions – you can better equip yourself to navigate the unpredictable world of trading.

The Distinction Between Trading and Investing

A common misconception among many individuals is the perception that trading and investing are interchangeable terms. This is a product of societal conditioning from formal education systems, which often emphasize rote learning and adherence to instructions, rather than fostering critical thinking skills.

Investing: A Long-Term Approach

When we discuss investing in the context of wealth accumulation, we're typically referring to long-term strategies. These may include diversifying your portfolio with assets such as real estate, Bitcoin, or precious metals. These investments are often viewed as valuable alternatives to traditional fiat currencies due to their intrinsic value propositions.

Take, for example, the significant surge in Bitcoin's value in late 2017. The cryptocurrency skyrocketed dramatically, reaching highs of over $18,000 and consequently creating numerous millionaires out of its investors. However, this success story isn't without its caveats. A significant proportion of these newly-minted millionaires and new investors who bought at the peak price ended up suffering substantial losses. This was primarily due to their investment strategy – they were holding onto their assets with an investor's mentality but lacked the strategic foresight of a trader.

This scenario is a widespread experience among beginners in the world of investment. It's important to note that even the most successful traders have likely navigated through similar learning curves.

Bitcoin 2017 – 2019 Market Cycle

Trading: An Active Participation in Market Dynamics

On the other side of the coin is trading, which involves active participation and engagement with market trends. As a trader, your decisions are influenced by calculated probabilities rather than emotional impulses. For instance, if you had strategically sold Bitcoins when they peaked at $18,000, and then repurchased them when the price dropped to $3,500, you could have tripled your Bitcoin holdings.

In the cryptocurrency sphere, you may have come across the term “HODL”. This is an acronym for “Hold on for dear life”. For many who venture into cryptocurrencies, the belief is that digital currencies hold greater power and potential than traditional fiat currencies. While this belief may hold true today and continue to do so in the foreseeable future, it's still crucial to exercise caution and diversify your investments. This includes both cryptocurrencies and traditional fiat currencies.

Remember, never put all your eggs in one basket – a balanced portfolio is key to mitigating risks and ensuring long-term financial stability.

The Fundamentals of Cryptocurrency Trading

If you're planning on entering the cryptocurrency trading sphere, it's paramount to grasp the foundational concepts that govern this market. Trading, at its core, is a zero-sum game. In simple terms, every trade has a buyer and a seller. Consequently, one party stands to gain while the other stands to lose.

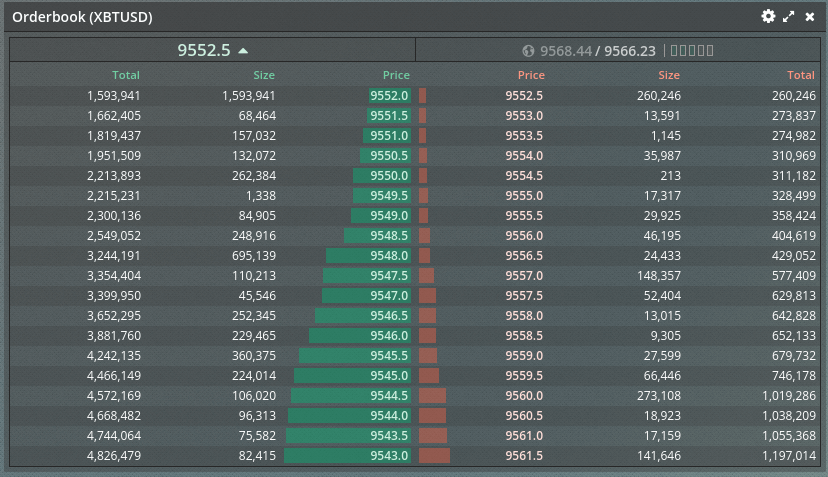

When two parties agree on a price for a particular cryptocurrency, a trade is executed and the market value of that cryptocurrency is established. Also, it's common to witness both buyers and sellers placing orders that are just a few digits apart from each other. This occurrence creates what is referred to as a spread, forming a gap between the sellers' and buyers' prices in the order book.

The dynamics of supply and demand are unmistakably visible in crypto trading. When there are more buyers than sellers, the price of a cryptocurrency tends to rise. Conversely, when there are more sellers than buyers, the price drops.

The Order Book: A Vital Component of Cryptocurrency Trading

Think of the order book as the control center of the cryptocurrency market — it's where the magic happens. This crucial tool is essentially a live, constantly updating list of buy and sell orders from traders all over the world.

Understanding Buy and Sell Orders

In an order book, you'll encounter two primary types of orders:

- Buy orders: These are bids placed by traders who wish to purchase a specific cryptocurrency. They specify the maximum price they are willing to pay per unit.

- Sell orders: These are offers by traders looking to unload their cryptocurrency holdings. They set a minimum price per unit they're willing to accept.

The constant interplay between these buy and sell orders shapes the crypto market's direction at any given moment.

The Role of Market Forces

The order book is more than just a list; it's a dynamic reflection of market sentiment and trader behavior. When you look at an order book, you're essentially viewing supply and demand in real-time action. Hence, it provides valuable insights into potential price movements.

For instance:

- If there are more buy orders than sell orders, it signifies higher demand than supply. This imbalance can push prices up.

- Conversely, if sell orders outnumber buy orders, it indicates an oversupply or lower demand which can lead to falling prices.

It's worth noting that not all orders have an immediate impact on the market price. Only when a buy and sell order match in terms of price does a transaction occur, affecting the market value.

Armed with an understanding of how an order book operates, traders can make more informed decisions. They can predict price trends, identify potential trading opportunities, and develop strategies based on the current market situation.

Remember, though, that while the order book can guide your trading decisions, it's not a crystal ball. Market conditions can change rapidly, and past patterns do not necessarily predict future behaviors. Still, the order book remains an essential asset for any committed cryptocurrency trader.

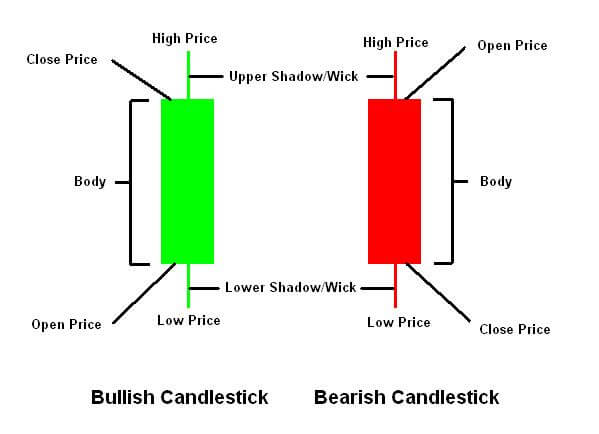

A Deep Dive into Candlestick Charts

Candlestick charts, also known as Japanese candlestick charts, are a vital tool for traders in the cryptocurrency world. They offer a visual representation of market activity, providing insights into potential trends and key price points. Below is a simplified explanation of how they work.

Anatomy of a Candlestick

Each candlestick on the chart represents a defined period of trading – this could be anything from one minute to one day, depending on the user's preference. A candlestick consists of two main parts:

- The Body: This is the rectangular area of the candlestick. It represents the range between the opening and closing prices for the period. If the body is filled or colored (usually red), it means that the closing price was lower than the opening price (a bearish period). Conversely, if it's empty or filled with a different color (usually green), it indicates that the closing price was higher than the opening price (a bullish period).

- The Wick: Also known as shadows or tails, these are lines that extend from the body up to the highest and down to lowest traded prices during the time period represented by the candlestick.

Interpreting Candlestick Patterns

One single candlestick can provide valuable information, but traders often look for patterns across multiple candlesticks to predict future market movements. Key things to consider while interpreting these patterns include:

- Trend Identification: A series of bullish (green) candlesticks signifies an uptrend, indicating buying pressure in the market. On the other hand, a series of bearish (red) candlesticks suggests a downtrend or selling pressure.

- Reversal Patterns: These occur when a pattern indicates potential reversal of an existing trend. For example, after a long bullish period, a bearish candlestick could suggest the beginning of a downtrend.

- Continuation Patterns: These patterns indicate that the current market trend is likely to continue. For instance, during a period of uptrend, a small bearish candlestick followed by a large bullish one could suggest continuation of the uptrend.

Remember, while candlestick charts can provide helpful insights, they should be used in conjunction with other technical analysis tools for better accuracy in predicting market trends.

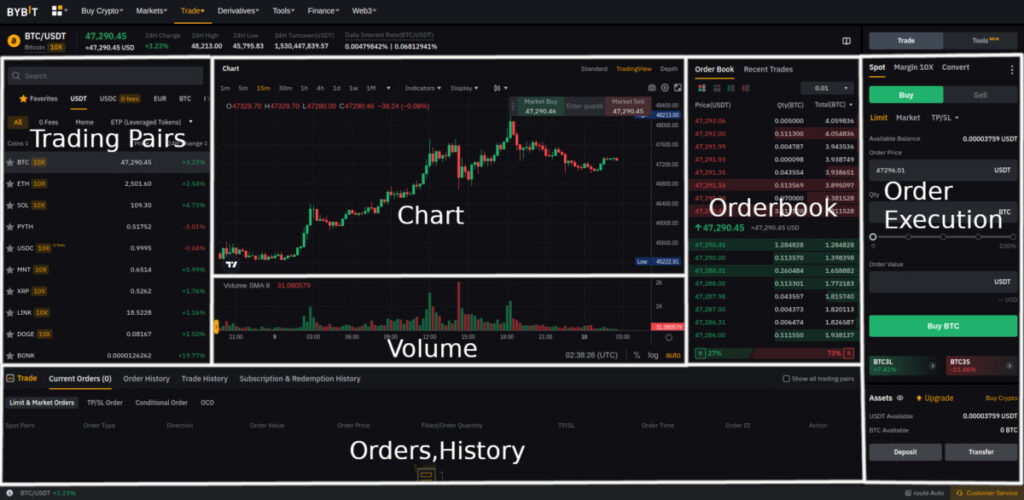

Decoding Cryptocurrency Trading Platforms: A Close Look at BTC Pairs and Exchange Interfaces

Cryptocurrencies, due to their decentralized nature and global reach, have given rise to a broad spectrum of fiat currency pairs in trading. Bitcoin (BTC), being the pioneering and most widely traded cryptocurrency, is commonly paired with several major global currencies. Typical pairings include BTC/USD, BTC/EUR, and BTC/JPY. However, depending on the exchange and region, traders may also encounter other pairs such as BTC/CNY (Chinese Yuan), BTC/CAD (Canadian Dollar), and BTC/RUR (Russian Ruble).

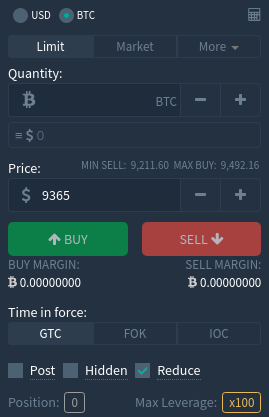

In this section, we will concentrate on Bybit and Phemex, two of the world's highest-volume cryptocurrency exchanges. Each exchange offers unique features that cater to different trader needs.

Understanding Bybit's Interface

Bybit stands out for its robust, fully customizable software tailored to suit traders' individual needs. It incorporates various features designed to enhance the user experience and facilitate effective trading:

- Order Execution: This feature lets you place buy or sell orders with ease.

- Order Book: A real-time list displaying all current buy and sell orders.

- Charts: Visual representation of market trends to help you analyze price movements.

- Volume Tracking: Allows tracking of the number of Bitcoins traded within a specified period.

- Order History: Provides an insight into the most recent transactions executed on the platform.

- Trade History: An archive of all your past trades which can be useful for performance review and strategy planning.

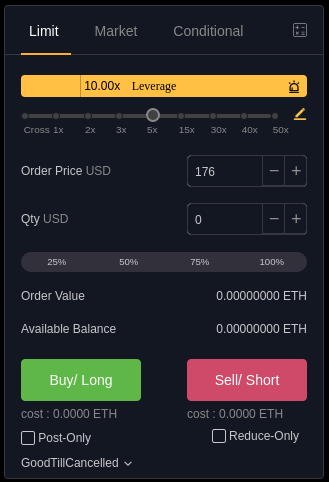

Exploring Phemex's User Interface

Phemex, in contrast, provides a sleek and intuitive trading interface suitable for all levels of traders. Whether you're a beginner or seasoned trader, understanding its interface will significantly improve your trading experience.

The platform layout is straightforward and easy-to-navigate, with essential trading tools and features readily available. Here are some key components of the Phemex interface:

- Order Execution: Allows you to place buy or sell orders.

- Order Book: Displays real-time buying and selling activities in the market.

- Charts: Offers a visual representation of the market trends to aid in-depth analysis.

- Order History: Gives an overview of your most recent transactions on the platform.

Whether you're engaging in BTC/USD trades as a beginner or managing multiple pairs as an experienced trader, understanding cryptocurrency charts on platforms like Bybit and Phemex is crucial for successful trade execution. By becoming proficient with these interfaces, you can effectively monitor market trends and make better-informed trading decisions.

Timeframes in Trading: A Closer Look

Trading charts offer a myriad of features that can aid in efficient and effective decision-making. One such feature is the ability to adjust the timeframe of the candlesticks. This simple yet powerful tool provides traders with the opportunity to view market trends from varied perspectives, thereby enriching their understanding of market movements.

In the realm of cryptocurrency trading, TradingView stands out as a premier platform for chart analysis, providing an all-encompassing solution for traders seeking to perform detailed market evaluations.

Understanding Price Chart Timeframes

The process of adjusting timeframes is straightforward. Essentially, it involves selecting your desired timeframe from the options available on your trading platform.

Here's a quick guide on how to leverage this feature:

- Start with larger timeframe candles such as weekly or daily. These provide a broad overview of market trends and help you understand the bigger picture.

- Gradually zoom in to smaller timeframes (hourly, 15-minutes, etc.). This allows you to analyze market behavior within those specific periods and identify short-term trading opportunities.

Remember: Cryptocurrency trading involves risk, and it's essential to do your due diligence before making any decisions.

By understanding how to adjust and interpret different timeframes, you can gain deeper insights into market trends. This, coupled with other basic trading concepts such as understanding trading patterns, volume, support & resistance, equips you with essential tools to navigate the world of cryptocurrency trading confidently.

Margin Trading: A Deep Dive

Margin trading is a popular strategy often utilized in cryptocurrency trading. Essentially, it involves the practice of borrowing funds to amplify potential profits from trades. By leveraging your trading capital, you can significantly increase the size of your positions and potentially maximize your profit output.

The uniqueness of the cryptocurrency market shines here. Unlike traditional markets requiring substantial initial capital, often upwards of $20,000 for leverage trading, crypto markets open the doors for traders with as little as $10. Certain cryptocurrency exchanges even offer the opportunity to borrow leverage up to 100x your initial investment.

Imagine this – with 100x leverage on an initial capital of $1000, you're looking at a staggering $100,000! This introduces an enormous profit potential if you can time your trades perfectly to capture even modest market movements.

However, it's crucial to understand that leverage is a double-edged sword. Just as swiftly as it can boost your profits, it can also lead to significant losses if not managed properly. Therefore, while leverage can be an effective tool for seasoned traders with well-established plans, it may spell disaster for those who approach trading casually without professional strategies.

Some pertinent examples of exchanges that allow Bitcoin borrowing with up to 100x leverage include Bybit, Phemex, MEXC, and SimpleFX.

Note: It's prudent not to dive straight into using 100x leverage; starting with a manageable 2-5x leverage is advisable.

For a comprehensive list of the best spot & margin trading exchanges available today, feel free to check out our curated list here.

Case Study: The 2019 – 2020 Bitcoin Market Cycle

As an example, consider a scenario where we initiate a long position at around the $3500 area with 10x leverage. Subsequently, on selling around the $13,000 mark, the profit would be over 2650% or 26.5 times our initial investment.

While margin trading can offer rapid wealth accumulation through cryptocurrencies, it's vital for traders to understand its intricacies and risks thoroughly. It's not just about making quick returns; it's also about managing potential risks that could wipe out your account balance. Always remember – knowledge is power. Equip yourself with the necessary skills and insights before diving into the world of leverage trading.

Understanding Order Types in Cryptocurrency Trading

When it comes to cryptocurrency trading, having a sound understanding of the types of orders you can place is crucial. There are a variety of order types available to traders, but in this guide, we will focus on the three most important ones: Market Orders, Limit Orders, and Stop Orders.

Before we delve into these order types, let's take a look at how they function on common exchanges like Deribit and Bybit:

Market Order

A Market Order is an order to buy or sell a cryptocurrency at its current market price. The key feature of a market order is that it guarantees execution – your order will be filled, but not necessarily at the exact price you expected.

For instance, imagine placing a market order when the best price is $9500. Due to rapid fluctuations in the market, other orders may get filled first, resulting in your order getting filled at $9505 instead.

When should you use a Market Order?

- When you prioritize execution over price.

- When you're buying, your market order gets filled at the asking price.

- Conversely, when selling, your market order will get filled at the bid price.

Limit Order

Unlike a market order, a Limit Order gives you control over the price at which your order is executed. You specify a price, and your order only gets filled if the market price reaches your specified limit.

For instance, if you place a limit order with a price of $9500, your order will only be executed at that exact price.

When should you use a Limit Order?

- When you want more control over the execution price.

- If you're buying, the order gets filled if someone is willing to sell at your specified limit (or lower).

- If you're selling, the order gets filled when someone is willing to buy from you at your limit (or higher).

Stop Order

A Stop Order, also known as a stop-loss order, becomes active only when the market price reaches a specific trigger point. Once activated, it's processed as either a market or limit order.

For example, if Bitcoin is currently priced at $9500, and you set a buy stop order at $9600. If the price reaches $9600 or higher, your stop order gets triggered and is processed.

When should you use a Stop Order?

- To automatically enter or exit trades based on predefined conditions.

- As a protective measure to limit losses on an existing position. For example, setting a sell stop at $9450 after buying Bitcoin at $9500 guarantees that your loss is capped at $50 per Bitcoin.

- Conversely, if shorting Bitcoin at $9500, placing a buy stop at $9550 can help mitigate potential losses.

Remember: Trading cryptocurrencies involves substantial risk. Understanding these key order types can provide an additional layer of control and protection in your trading strategy.

Explored Horizons: Four Main Types of Cryptocurrency Trading

In the realm of trading, independence is a key feature. You are the architect of your own destiny, free to design your schedule and refine your skills according to your preferences. This liberty brings with it the need for strategy, particularly when determining which trading timeframe aligns most closely with your abilities. For instance, my personal strength lies in accurately forecasting movements down to the minute. Depending on market conditions, this could mean executing up to 20 trades per day. However, when the market structure is favorable, I may also hold a few swing trades occasionally. Given Bitcoin operates 24/7, pinpointing the perfect position can be somewhat challenging, especially for those residing in European timezones as major moves often occur during Asian market hours.

1. Day Trading: The Fast-Paced Route

Day trading represents the shortest trading timeframe. As its name suggests, positions are opened and closed within a single day. This style mainly constitutes my trading activity. However, it's crucial to remember that significant volume is essential for successful day trading. During periods of sideways market movement, profits can easily be eroded or you may find yourself squabbling over insignificant gains. Despite its challenges, day trading can be highly lucrative if you've mastered the art of anticipating market movements and are able to be active during peak trading times.

2. Swing Trading: A Balance Between Speed and Patience

Swing trading involves holding a position for a few days to a couple of weeks. It can yield high returns with Bitcoin as price action often unfolds over several days. Not everyone has the capacity or inclination to constantly monitor minute-by-minute charts – and why should they? If you're able to identify a promising trend and capture a portion of it, this could result in price movements ranging from 15% to 50%.

3. Position Trading: The Long Game

Position trading is akin to investing. It involves building a position over several months or years before cashing out. I, for instance, have been strategically positioning myself with various cryptocurrencies for years as the traditional fiat system grows increasingly fragile. This strategy doesn't involve haphazard purchases; rather, it's about identifying key buying zones or finding highly undervalued assets that mathematically justify investment – much like Bitcoin in its early days.

As we witness the crumbling fiat system, another position trade worth considering is buying precious metals such as gold and silver.

4. Arbitrage Trading: Profiting from Price Differences

Arbitrage trading involves buying and selling different cryptocurrencies on multiple markets to profit from price discrepancies. Given the relative novelty of cryptocurrencies, numerous arbitrage opportunities exist across various exchanges. An example of cryptocurrency arbitrage might involve purchasing coins on KuCoin where prices are lower, and simultaneously selling them on Bitget, pocketing the price difference as profit.

This overview of the four main types of cryptocurrency trading should provide a better understanding of which method aligns with your personal abilities and preferences. Each type has its unique advantages and challenges, but all offer opportunities for profitability in the dynamic world of cryptocurrency trading.

The New Trader VS The Old Trader: A Comparative Analysis

When one delves into the realm of cryptocurrency trading and price charts, it's quite common to see beginners getting caught up in the intricate details. Their focus often gravitates towards the more flashy aspects, which may not necessarily be crucial elements for successful trading.

Common Mistakes of New Traders

We have all come across that enthusiastic newbie on Twitter, their charts a riot of vibrant hues, dazzling lights, and an elaborate array of indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and OBV (On Balance Volume). These are just to name a few.

“The truth of the matter is you don't need any of those indicators to be a professional trader.”

However, what needs to be understood is that these indicators aren't a prerequisite for becoming a proficient trader. In fact, embracing simplicity can often enhance your profitability. This isn't to completely invalidate the utility of these indicators – they certainly have their purposes. I myself am well-versed in their application and nuances. Yet, I seldom find the need or spare the time to load them onto my charts to comprehend what's actually transpiring.

Limitations of Indicators

Most indicators available are inherently lagging in nature – they trail behind the price action. The main drawback here is that they offer information based on past market conditions; they're reactive rather than predictive.

“Focus on price action instead; it is what matters the most.”

To truly excel in trading, shifting focus towards price action can yield better results. It represents real-time data about market sentiment, offering valuable insights into potential future movements.

Perspective of Professional Traders

In stark contrast to new traders, seasoned professionals perceive charts for what they truly represent:

- An interplay of market emotions

- A reflection of collective trader psychology

Understanding these emotional dynamics driving the markets is pivotal. It's not about overloading your charts with a plethora of indicators, but comprehending that these charts are merely visual representations of human emotions and market sentiment in action.

Understanding Market Cycles: Identifying the Trend

In the vast world of trading, one might assume that the market is a complex labyrinth. However, once you understand its mechanisms, you'll find that it is actually quite straightforward. The market moves in cycles and at any given moment, it can only do one of the three things:

- Trending

- Channeling

- Breaking out

These movements are not linear; markets do not travel straight up or down. Therefore, to navigate successfully through these fluctuations and anticipate the next turn, it's critical to identify the current cycle accurately.

Utilizing moving averages (50 & 200) to identify trends: A simple yet effective example

For newcomers in the trading arena, making money often seems most feasible during a bull trend. This is primarily because bull trends are typically the easiest type of trade for most people to execute. The process is simple – once a market has established a clear upward direction, you enter the trade.

However, a common pitfall among novices occurs when the bull trade concludes. New traders tend to hold on past this stage and miss the opportunity for initiating the next profitable trade. This scenario forces them to give back their earnings.

One of the most common phrases in trading is buy low, sell high. Despite its widespread usage, many beginners find themselves late to jump on trends and end up doing precisely the opposite – buying high and selling low.

“In trading, profits are made by identifying the trend early and then positioning yourself for what's coming next.”

It's important to remember that your entry or exit price doesn't solely determine your success in trading. What matters more is predicting correctly whether there will be an increase in the number of people wanting to follow your action after you. Trends can develop on both sides of the market, and it's worth noting that fear often overpowers greed. This dynamic is why we see bulls building steady steps upwards, and bears swiftly taking the elevator down.

Trading Against The Masses: An Evolutionary Perspective

Humans, as a species, have evolved over thousands of years in the savannah. Our survival during this period was contingent on our ability to avoid predators lurking nearby. This necessitated the development of certain skills and behavioural tendencies that were crucial for survival.

- We learned to depend on our instincts for immediate responses.

- We began to stick together as a group, ensuring collective safety.

- We opted for safe bets, minimizing risks for better survival outcomes.

These behaviour patterns were instrumental in our evolution and eventual dominance over the world. However, the modern world we live in today is starkly different from our ancestral savannah. While there are no longer predators ready to pounce on us from every corner, our brains continue to operate using the same old survival mechanisms.

When it comes to trading, these deeply ingrained survival instincts often hinder us from making profits. The tendency to follow the crowd or ‘the herd' is an instinctual response that has been passed down generations. When everyone else is driving the price up during a bull run, it's easier and feels safer to join them rather than stand against the tide and buy when everyone else is panicking. This behaviour stems from our basic human nature and innate desire for social conformity.

“Markets tend to reverse when the mass majority of people are expecting them to continue.”

Among traders, this phenomenon is often referred to as FOMO, or Fear Of Missing Out. It's the anxiety that an exciting or interesting event may currently be happening elsewhere, often aroused by posts seen on social media.

Trading against the masses, at its core, means understanding what the majority of people are thinking so you can anticipate their next move. To succeed in this, you need to:

- Recognize your own biases: Acknowledge that your instincts might not always lead to the best trading decisions.

- Understand market sentiment: Use analytical tools to gauge the mood of the market.

- Develop contrarian strategies: Sometimes, going against the tide can yield significant profits.

Remember, in trading, being right isn't about following the crowd; it's about anticipating the crowd's next move and staying one step ahead.

Understanding Market Structures in Trading

New traders often fall into the trap of focusing too narrowly on minute-by-minute market movements, or they may take the opposite approach, buying and holding without a solid strategy. This is akin to attempting a complicated surgical procedure without any prior knowledge of the tools or techniques involved – it's likely to end in disaster.

Just as a surgeon needs to understand their tools and processes, traders need to grasp key methodologies that can guide their decision-making process. One of these is the ability to read price charts effectively. This should be done in the same way you would read a book – from left to right.

Historical Patterns and Price Levels

The axiom that “history tends to repeat itself” holds true in trading. The ability to look back at historical charts allows traders to identify significant price levels known as support and resistance.

Notice how the market is currently respecting major resistance and support areas that are over two years old.

A common thread across all markets, not just with Bitcoin, is their tendency to move from one major support or resistance area to another. An essential concept to remember here is: when resistance breaks, it often turns into support; similarly, when support breaks, it often turns into resistance.

Bitcoin breaking a channel that lasted over 6 months. (Note that this is the same chart as above but zoomed in.)

Recognizing Market Patterns

Markets may form various patterns such as triangles and channels, as they fluctuate between sellers and buyers. Recognizing these patterns can be crucial for successful trading, given the human brain's exceptional ability to identify recurring patterns.

The key strategy here is to start with larger time frames to eliminate the noise of minor fluctuations. After identifying the major zones, you can zoom in to understand what the market is doing within these zones and plan your trades accordingly.

The Power of Focusing on Major Price Zones

Paying attention to major price zones can bring multiple benefits:

- It saves time and energy by eliminating the need to track every minor market movement.

- It prevents frustration that often comes from attempting to make sense of minor fluctuations.

- It helps develop a more strategic approach to trading, ultimately making you a better trader.

Remember, in trading as in any other field, knowledge and strategy are key to success.

Altcoin Trading & Investing: Navigating the Cryptocurrency Landscape

Beyond Bitcoin, an array of other cryptocurrencies, known as altcoins, exist in the dynamic digital currency market. While a significant number of these altcoins are scams that should be avoided, there are legitimate options that provide active traders with numerous trading opportunities. This remains true even during bear markets when prices are falling. Occasionally, you may also discover hidden gems offering innovative solutions to the industry.

If you've accrued some Bitcoin and wish to expand your portfolio, investing in altcoins can be a worthwhile venture. However, it's crucial to select coins based on their potential for substantial future gains. Although no one can predict an altcoin's future with absolute certainty, certain coins perform better due to technical advancements, effective marketing strategies, or other factors that influence public perception.

Insight: Nexus is a universal quantum-resistant contract engine.

Investing in altcoins can yield high returns due to the larger percentage gains typically seen in the cryptocurrency space. The low liquidity of many of these coins has led to price surges of up to +20,000% and beyond–returns that far outpace those seen in traditional markets.

However, the key to successful altcoin investing lies in thorough research. Much like traditional markets, most coins go through boom and bust cycles and many end up worthless eventually. But every so often, new coins emerge that have the potential to disrupt the industry. These are the hidden gems worth investing in – examples include Ethereum, Monero, and Dash.

Altcoins with a short price history often lack a clear bottom, making it difficult to gauge their value. It's essential not to purchase coins that haven't yet defined a clear bottom, as it's uncertain how much further they could fall. Once a coin has established a clear bottom and returns to its previous lows, this low can be used as a support level.

A useful tool for tracking altcoin prices and charts is coinmarketcap.com, the industry's most popular crypto price tracker.

One major advantage of investing in altcoins over traditional markets is the accessibility of open-source projects. Most cryptocurrencies maintain chat discussion rooms open to everyone, providing direct contact with lead developers and project teams–the equivalents of CEOs and management teams in conventional companies. This level of accessibility is virtually unheard of in traditional markets.

Unmasking Market Makers: The Untold Truth

In the vast and intricate world of financial markets, it's crucial to comprehend that no matter how significant your stakes or influence might be, there's always a bigger player in the game. These colossal entities are what we refer to as Market Makers. They often operate behind the veil of institutional bodies or even governments, quietly steering the direction of markets.

This isn't to undermine the role emotions play in market dynamics. However, it's to highlight that the proficiency of professional traders stems not only from their ability to gauge overall market sentiment but also decipher what the Market Makers' sentiment or plan is at any given time.

The Necessity of Market Makers in Traditional Markets

As previously discussed, order books are the pulsating heart of any market. However, in reality, there aren't enough individuals or parties involved to fill up all the order books worldwide. This is where Market Makers step into the picture. Their primary responsibility is to populate these order books, guaranteeing that traders can execute trades at their desired price point at any given moment.

A Glimpse into Market Maker's Perspective on Markets

Interestingly, Market Makers don't operate by the same rules as traditional traders. Their role isn't about predicting price movements – they're the ones who set prices. The collective reaction to these set prices determines the actual price we see reflected in our trading platforms. In essence, Market Makers profit from the spread (the difference between the buy and sell price) of any given market. Whether prices rise or fall doesn’t significantly affect them – their profits stem from transaction fees generated by users executing trades on various platforms.

The Ubiquitous Nature of Market Manipulation

As startling as it may sound, this essentially means all markets are inherently manipulated. Smaller markets may see less manipulation due to limited activity, but no market is immune. In global markets, this manipulation becomes even more evident and easier to identify.

Astute traders can spot these patterns of manipulation on charts and react strategically before the majority. This ability to navigate and leverage market manipulation can be a powerful tool in a trader's arsenal.

Remember:

- Market Makers are not adversaries; rather, understanding their role and actions can empower you in your trading journey.

In conclusion, the world of trading is an intricate one, fraught with unpredictable twists and turns. But with a keen eye for detail, a deep understanding of the role of Market Makers, and a proactive approach towards market dynamics, you can turn these challenges into opportunities.

Remember to stay vigilant, keep abreast of trends and patterns in market manipulation, and fine-tune your strategies in response to these insights.

Crafting Your Personal Trading Plan: A Comprehensive Guide

Trading in the realm of cryptocurrencies requires more than mere chance—it demands a well-structured plan. The crucial difference between an unsuccessful gambler and a professional trader lies in their approach. While the former is often driven by the thrill of adrenaline, professional traders focus on wealth building, treating trading as a serious business venture. As you wouldn't hand over your hard-earned money to a stranger without solid reasoning, it's equally unwise to plunge into the market without a robust business plan.

Defining Your Trading Plan

A trading plan serves as a set of rules framing your trading activity, guiding your decisions about what to trade, when to make moves, and how much to invest.

It's essential that your trading plan is a reflection of your personal values and goals. Every trader is unique in their values, risk tolerance and financial objectives—all of which should be incorporated into your plan.

A comprehensive trading plan could include elements like:

- Your motivation for trading

- Financial goals

- Time commitment

- Attitude towards risk

- Available capital

- Risk management protocols

- Strategies

- A trading diary for record keeping

Building Your Three-Step Trading Plan

Creating an effective trading plan doesn't have to be complicated. Here's a simple three-step process you can follow:

- Recognize Patterns

- The bedrock of successful trading lies in recognizing patterns from historical price movements and leveraging this insight to forecast future trends. Solid chart analysis skills enable you to pinpoint lucrative entry points—avoiding market highs where conditions are overbought and primed for a downward turn. Some patterns will recur more frequently than others; traders often assign names to these common trends, such as ‘support' and ‘resistance.'

- Set & Forget

- Risk management is arguably the most crucial component of any trading plan. Once you've identified a pattern and entered a position, it's time to define your profit targets and set stop losses. This strategy reduces risk and safeguards your gains.

- Embrace Continuous Learning

- Keep your strategy fresh by constantly testing new trading theories and strategies. One of the safest ways to do this is through paper trading—using virtual funds in real market conditions. Most trading platforms offer this feature as part of their service.

The Bottom Line

While paper trading can provide valuable insights, it's not a surefire predictor of success with real money trades. The introduction of real capital can stir up emotions that impact your decision making.

Remember, trading is more akin to a marathon than a sprint—don't expect instant riches. It's essentially a game of probabilities where winning and losing go hand in hand. By letting profits ride and cutting losses short, you may lose some battles, but you’re setting yourself up for ultimate victory in the war.

Taking Stock of Cryptocurrency Trading

The world of Bitcoin and other cryptocurrencies presents an exciting frontier for those enthusiastic about the potential of digital currency. This realm teems with possibilities that could lead to significant financial gains, much like a once in a lifetime jackpot.

However, it's essential to remember that, for the uninitiated, this can be quite a treacherous path. Much like any high-risk high-reward arena, without the correct set of tools and knowledge at your disposal, navigating the landscape of cryptocurrency trading could turn out to be quite hazardous.

Embrace Your Early Advantage

Luckily for you, being relatively early to the cryptocurrency game can be a considerable advantage. As the saying goes, the early bird catches the worm. By equipping yourself with accurate and timely knowledge, you can leverage this advantage to make strides forward in your crypto trading journey.

Beware of Potential Scams

While keeping an optimistic gaze towards future prospects, it is equally important to stay vigilant. The cryptocurrency market has had its share of infamous scams, pump-and-dump schemes, and various other unsavory activities. It is crucial to keep a watchful eye on these potential pitfalls as you traverse through this wild west of crypto trading.

Remember: “Never invest what you can't afford to lose!”

This statement rings true more than ever in the unpredictable world of cryptocurrency trading. Always follow this golden rule while taking your steps into this exciting new world of digital assets. Invest wisely and cautiously – your financial well-being may depend on it.

Further Reading & Useful Tools

To delve deeper into the realm of cryptocurrency trading and its various facets, we've compiled a comprehensive list of related articles and tools. Each of these resources provides valuable insights and can aid in enhancing your trading strategies.

- Understanding Crypto Price Charts: Cryptocurrency technical examples often rely on TradingView price charts. As the world's leading charting platform and social community for traders, it has a strong connection to Bitcoin, gaining popularity alongside the rise in cryptocurrencies. Importantly, this powerful tool is available to use for free.

- To expand your knowledge on this topic, check out our detailed guide on the best crypto charting software.

- The Intersection of Bitcoin and Gold: Consider diversifying your investments by trading Bitcoin for precious metals like gold using platforms such as BullionStar or Vaultoro.

- This strategy might be beneficial during market peaks when you're looking to secure your Bitcoin profits, protect against inflation, or boost returns during weaker fiat time periods. If this intrigues you, explore our guide on how to buy gold with Bitcoin.

- Harnessing the Power of Crypto Trading Apps: With the 24/7 nature of cryptocurrency markets, a reliable cryptocurrency trading app can be indispensable for tracking your trading positions on-the-go.

- Navigating Portfolio Tracking & Taxes: Despite the decentralized nature of cryptocurrencies, governments require taxes on profitable trades. Utilize these services to streamline portfolio tracking and tax filing. Simply import your trades from exchanges and auto-convert prices. We recommend CoinTracking for its comprehensive features, but feel free to explore our full list of portfolio tracking services here.

- Leveraging VPN for Bitcoin Trading: A reliable VPN provider can offer you unrestricted internet access by bypassing geo-location barriers, enhance privacy, and protect against potential threats. For instance, American customers can access platforms like MEXC & Phemex, which are otherwise restricted in the US.

- Exploring Automated Bitcoin Trading Bots: An automated Bitcoin trading bot can track multiple altcoin pairs simultaneously, something human traders may find challenging. These bots function without rest or emotional interference and can execute trades as per your set parameters. One such bot we recommend is 3Commas. If you're interested in exploring more options, check out our full list of automated trading bots or read our detailed article on the same.

FAQs(Frequently Asked Questions)

How do I begin my journey with Bitcoin trading?

Embarking on the journey of trading with Bitcoins is a significant step in the world of cryptocurrency. To begin, you can start by acquiring Bitcoins through various methods such as purchasing from a cryptocurrency exchange, receiving them as payment for goods or services, or mining them.

What should I do after acquiring my first Bitcoins?

Once you've purchased your first Bitcoins, it's time to set up your trading account. This involves choosing a reputable cryptocurrency exchange, creating an account, and securing it with necessary security measures such as two-factor authentication.

Why is financial literacy important for wealth distribution?

Financial literacy plays a crucial role in wealth distribution as it empowers individuals to make informed financial decisions, understand investment opportunities, and effectively manage their resources. By enhancing financial literacy on a societal level, the distribution of wealth can become more equitable.

What are the main types of cryptocurrency trading?

In the realm of trading, independence is a key feature. The main types of cryptocurrency trading include day trading (shortest timeframe), swing trading (holding positions for a few days to weeks), position trading (similar to investing), and arbitrage trading (profiting from price differences). Each type has its own strategies and risk profiles.

Why is it important to recognize market patterns in trading?

Recognizing market patterns is essential in trading as it allows traders to anticipate potential price movements and make more informed decisions. Markets often form various patterns such as triangles and channels, and understanding these patterns can provide valuable insights into market dynamics.